The Pre-Start

Lundin Gold reported 2026 guidance of 475-525koz at an AISC of ~US$1,145/oz (LUG.TO)

Ramelius has announced a $250m on-market buy-back to run over the next 18 months, while increasing the minimum dividend level to 2cps (RMS)

Byrnecut lifted its stake in Wiluna from 19.9% to 24.3% through a private purchase from Maxim Geyzer at A$0.725/sh (WMC)

Hot Chili confirmed a near-surface higher-grade core at La Verde Cu-Au project, returning 47m at 0.57% Cu and 0.12 g/t Au from 247m (HCH)

Meteoric produced its first batch of MREC from the pilot plant at the Caldeira project in Brazil (MEI)

The Mining Inspectorate of Sweden granted Talga exploitation concessions for Nunasvaara North, Niska South and Niska North at Vittangi for a 25-year term, subject to appeals within 5 weeks and environmental permitting (TLG)

Great Boulder is in a trading halt pending an update on drilling at Side Well (GBR)

Black Canyon completed a PQ3 diamond program, yielding ~2t of core for met testwork, finished a heritage survey and plans further drilling at Wandanya & Wandanya South (BCA)

Firebird's MFP precursor PCAM exceeded China industry standards in internal and third-party tests after more than 150 batch runs producing ~200kg, with 30kg supplied to a potential downstream customer (FRB)

High Grade It

BHP has struck a groundbreaking $3B infrastructure deal that could reshape how miners fund their operations while maintaining strategic control (Australian)

Iron ore fell to a month low ahead of a key meeting of Chinese officials that will provide details on policy priorities for next year (Bloomberg)

The U.S. military said it plans to develop a fleet of small-scale refineries to produce critical minerals used to make bullets & other types of weaponry (Reuters)

Silver was little changed after breaking above $60/oz for the first time on Tuesday (Bloomberg)

Ausgold to detail Katanning gold project’s environmental strategy after hydrologist’s claims of ‘omissions’ (West)

Tired of mining volatility? Exceed Capital offers steady, commercial property-backed performance. Their flagship fund The Collective targets 7-8% monthly-paid cash returns plus capital uplift.

BHP has entered into a US$2B infrastructure deal with BlackRock’s GIP to sell a 49% interest in its WAIO inland power network. BHP will pay a tariff over 25 years (BHP)

Anglo & Teck shareholders voted to approve the merger to form Anglo Teck (ALL.L)

South32 is pondering acquiring West Musgrave from BHP while continuing to consider a sale of Cannington, which could fund the deal, according to Dataroom (Australian) Right. S32 who sold their 2% NSR royalty on West Musgrave a couple of years ago. Not buying it.

St Barbara has been halted pending announcements on potential material transactions at Simberi (SBM)

Rio2 has acquired the Condestable mine from Southern Peaks for US$180m upfront and US$37m in deferred consideration. The mine is an underground producing copper operation, forecasted to do 27ktpa CuEq (RIO.TO)

St Barbara has requested a trading halt pending announcements on potential material transactions at Simberi (SBM)

Pacific Lime and Cement signed a PDA with the PNG Government for its Central lime and cement project, giving the state 13% equity (plus 5% option) (PLA)

Xinhai Mining Services has offered to invest up to $11m in Ariana Resources to support feasibility work for the Dokwe gold project in Zimbabwe (AA2)

Medallion & IGO have extended the Asset Sale Agreement sunset date for the Forrestania nickel operation to 20 Feb (MM8)

Volt executed a binding term sheet with Unbounded Opportunities Fund to fund the Bunyu graphite project, committing US$11m for a 62% stake (VRC)

CRML executed a term sheet to form a 50/50 JV with Romanian state‑owned FPCU for a 50% offtake of Tanbreez REE concentrate (EUR)

Smackover Lithium, a JV between Standard Lithium & Equinor, said it’d attracted $1B+ in financing interest for its Arkansas lithium project, including from the US EXIM bank (Reuters)

Concurrent to Rio2’s acquisition, it launched a bought deal, which it has upsized to C$166m (RIO.TO)

Lindian entered an underwriting with Petra for 17.8m options expiring 9 Dec 2025 to raise about $5m on conversion (LIN)

Astral raised $65m via a two-tranche placement of 325m shares at $0.20 (AAR)

Torque raised $15m via a $0.30 per share placement (TOR)

Almonty lifted its raising to US$112.5m at US$6.25/share (ALL)

Word on the Decline - The Battle for Bankan

We now believe Predictive and Robex have landed on a recut deal, which is more than likely to be announced tomorrow (unless this column accelerates that…)

There are no prizes for guessing the exact split of a recut deal. But heck, let’s try anyway

And in the spirit of the Ashes, here’s our punt 🎯

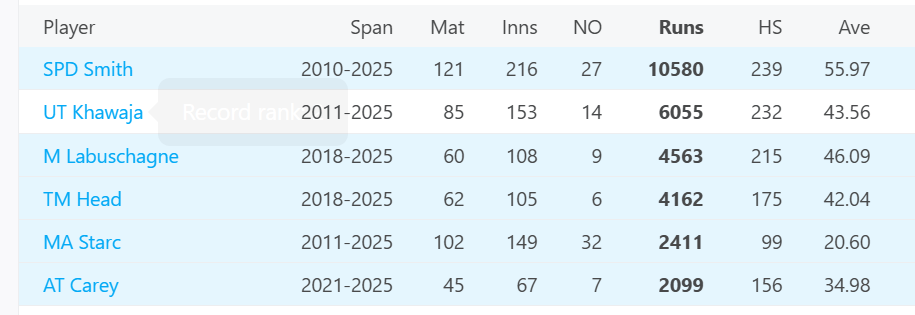

Travis Head is the in-form batsman of the series but our tip is that Robex shareholders will get a percentage of MergeCo closer to Marnus Labuschagne’s test average in a recut Predictive deal.

To be a bit more precise, assume Marnus gets 87 and out next innings…

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Performing DD on Junior Miners: Christopher Schmidt (YouTube) A 101 for exploration investing

Future CEO or back-office? Towards understanding your workplace persona (Strictly Boardroom)

How BHP can sell essential assets and still claim victory (AFR Chanticleer) The infrastructure sell down rolls on

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

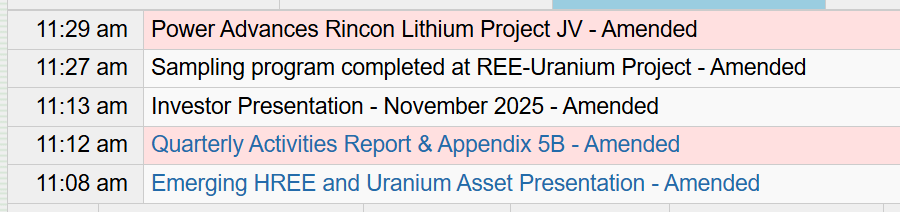

New record for the most amended announcements to go out in a single day?

Power Minerals…

Our Latest Show

Featuring: Rick Squire, Ben Richards, Warren Gilman, Kingsley Jones, Henry Ruehl, Hedley Widdup, Russell Delroy, John Forwood, Chris Berry, Anthony Kavanagh, Sam Berridge, Samuel Pelaez, Christopher Schmidt