The Pre-Start

BHP declared an interim dividend of US$0.73 per share (60% payout ratio). It reported a half-year profit of US$5.6B (up 28%) on revenue of US$28B, with the copper rally driving earnings (BHP) Profit weaker than US$6b expectation, huge stream deal below

Lundin Mining (50/50 with BHP) published a Vicuña district PEA (Filo del Sol + Josemaria) outlining a staged, 70+ year “top-five” scale Cu-Au-Ag operation, averaging ~400kt Cu, ~700koz Au, and ~22Moz Ag per year for 25 years, with base-case after-tax NPV8 US$9.5B (IRR 14.8%) and Stage 1 capex US$7.1B (LUN.TO) Potential sanctioned decision as early as year-end

Bellevue approved the construction of a new 120m3/hr wet paste plant for paste fill at Deacon & Deacon North. FY26 growth capital lifted by $25m (BGL)

Deterra reported 1H26 revenue of $117m, record NPAT of $87m, net debt of $149m and declared a fully franked interim dividend of 12.4 cps (DRR)

Black Cat reported assays from 24 holes at Mt Clement, including 5m at 2.52% Sb from 118m and 7.9m at 26.3 g/t Ag from 558m (BC8)

Macmahon reported revenue of $1.3B, underlying EBITDA of $200m, & NPAT of $48m for the half-year. Net debt was $144m, while paying a 0.95c dividend (MAH)

GR Engineering was appointed preferred EPC contractor by Brightstar’s Laverton processing plant (~$115m contract), pending FID (GNG)

Medallion approved FID for the Ravensthorpe gold project, signing a US$50m loan facility and copper‑gold concentrate offtake with Trafigura (MM8)

MLG reported HY2026 revenue of $287m, statutory NPAT $7.1m, pro‑forma EBITDA $37m and declared an interim dividend of 1.25c per share (MLG)

Sovereign signed a non-binding MOU with Traxys to market graphite from Kasiya, targeting about 40ktpa in years 1–5, rising to up to 80ktpa(SVM)

Lunnon’s drilling returned 13m at 5.7 g/t Au plus other thick intercepts, confirming potential for a northwest open-pit cut-back at Lady Herial (LM8)

PTR reported Batch 3 assays from the Rosewood titanium project, highlighting a best intercept of 33m at 15.7% HM from 10m. MRE due Q2 2026 (PTR)

Viridis' infill drilling at Colossus returned multiple near-surface intercepts, including 8m at 9,118 ppm TREO (VMM)

Golden Horse’s first 2026 diamond hole at Hopes Hill intersected visible gold and returned 4m at 4.6 g/t Au from 297m (GHM) Just in time for RIU!

Cauldron added 13.6mlb eU3O8 (32%), lifting Yanrey uranium project resources to 55.6mlb (CXU)

Mont Royal’s geological review finds the BD-Zone could grow the Ashram rare earth & fluorspar project resource (MRZ)

Terra Metals confirmed a PGM-Cu-Ni feeder system at Southwest SW6, with mineralisation >200m apparent thickness open at depth (TM1)

High Grade It

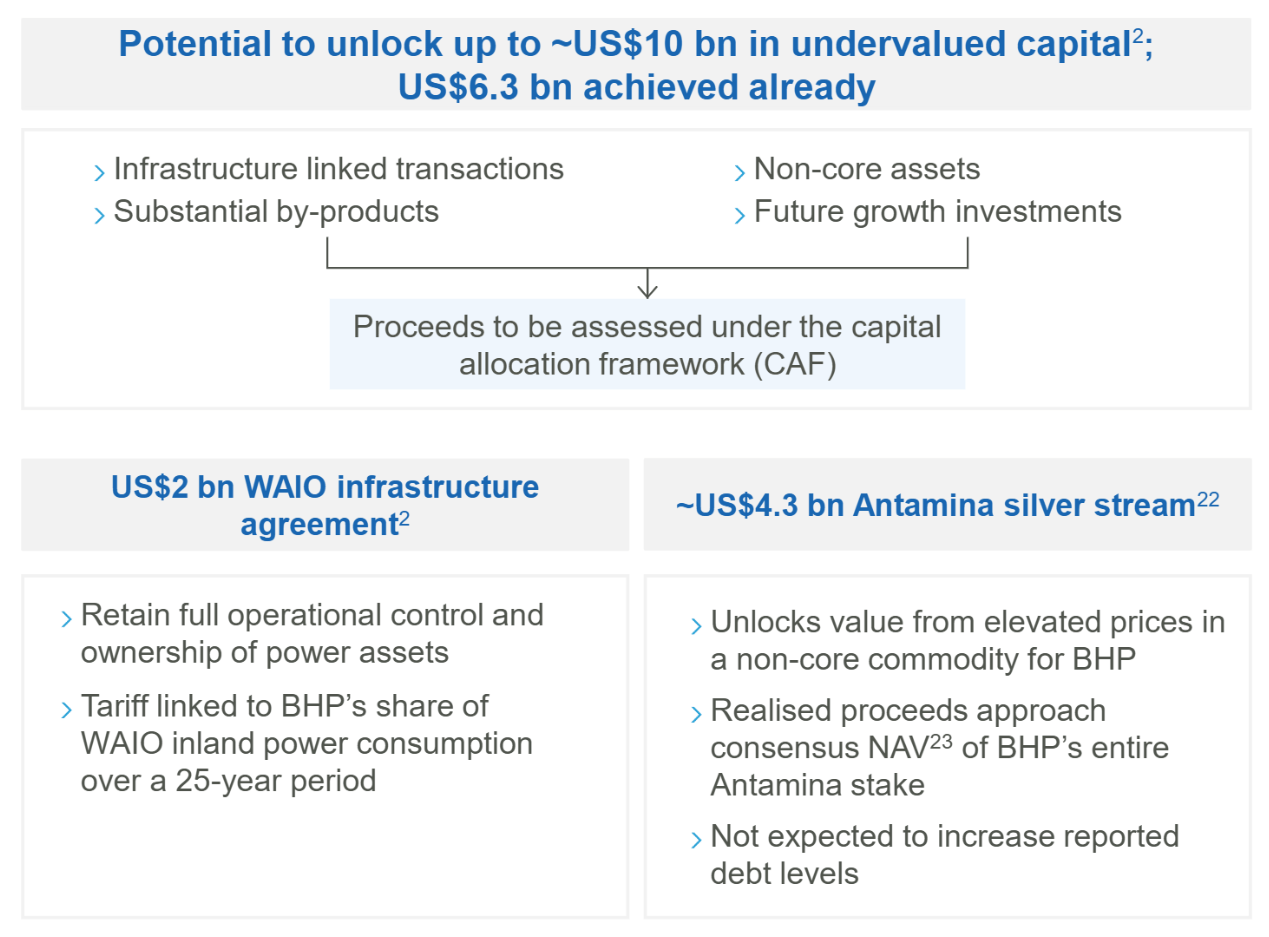

BHP will be paid an upfront fee of US$4.3B in exchange for its future silver production, as it looks to asset sales and other creative methods to cover rising spending on growth projects (AFR)

Shares in WA’s big three iron ore miners took a hit on Monday as concerns mount over growing stockpiles in Chinese warehouses (West)

Laopu and CMOC each rose more than 7% at their highs after being added to Hong Kong’s equity benchmark gauge (Bloomberg)

Some staunch gold bulls are shrugging off the precious metal’s historic correction, betting on the price surging by year's end (Mining.com)

European coal futures climbed for a 4th day after a drone attack on a Russian Black Sea port that handles sizable exports of the fuel (Bloomberg)

Copper miner Codelco has dismissed 3 executives after its El Teniente audit (MW)

Zambia mine regulator lifted the suspension of operations at Mopani's Mufulira mine (Reuters)

Trafigura's Nyrstar shipped its first antimony batch from Port Pirie (Reuters)

Invest in the Gold Coast’s growth engine with Exceed Capital’s SP Property Trust. Hosting blue-chip tenants while paying monthly distributions - you can find out more here.

Matt Latimore’s M Critical Minerals has acquired the Mittigudi and Leichardt copper projects from Rio Tinto in Queensland’s North West (M Resources)

Genesis Minerals shares surge on ‘very logical’ $639m bid for gold rival Magnetic (Australian)

BHP struck a record US$4.3B silver stream with Wheaton over its 33.75% share of Antamina, delivering 33.75% of payable silver output, stepping down to 22.5% after 100Moz, in exchange for upfront cash plus 20% of spot per ounce (BHP)

Horizon Minerals launched a $175m capital raising (AFR)

Austral is in halt pending a proposed capital raising (AGD)

Word on the Decline

The biggest news today is clearly the world’s largest streaming transaction ever between BHP and Wheaton. Not just because of the size of the deal, but because it is very unlike BHP to stream a byproduct.

The transaction follows BHP flagging it could unlock up to US$10B. With gearing already comfortable, it raises a fair question, why now?

One answer is capex profile - but that’s boring. Another is deal firepower - much more interesting to entertain.

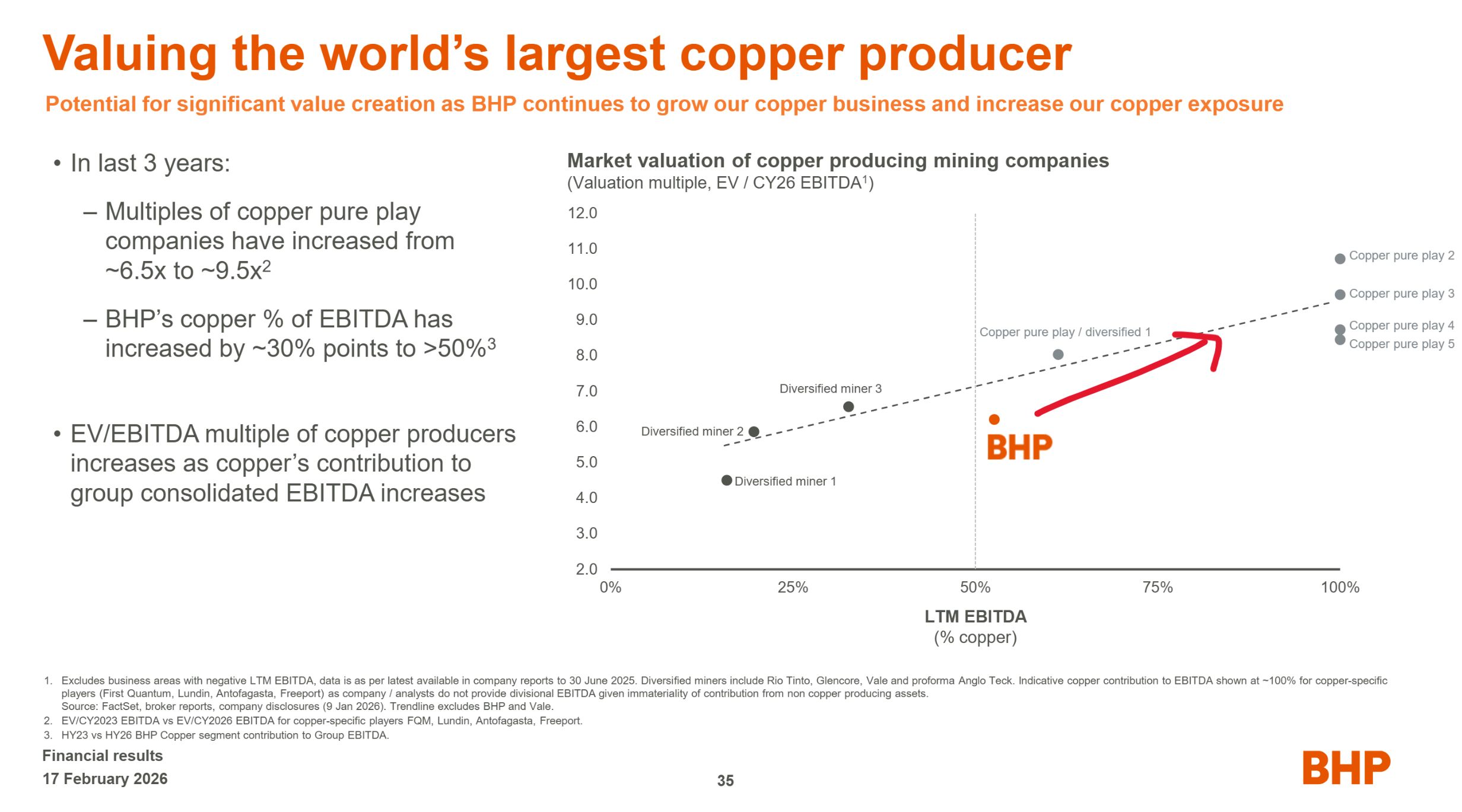

And if this Appendix slide tells us anything, it’s that BHP wants to be further to the right on this chart…

And the only way to get there this decade is by buying an established copper producer of scale

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Does the US-led offer for Glencore's DRC assets make sense? (Substack) Analysis with spreadsheet to toggle the dials yourself

Back to dig and deliver for lithium after another processing flop (Dryblower)

Louis-Vincent Gave and David Hay on the current investment environment (YouTube webinar)

The best setup I’ve seen in 40 years (Darko Kuzmanovic) Deglobalisation, AI and electrification are colliding with years of underinvestment for resources

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

BHP just streamed Antamina silver, yet byproduct credits are set to grow 63%?? Certainly outpacing growth in actual copper unit growth, which looks to rise ~40% over the same period. What the heck is happening here?

And right before sending this email, we opened our eyes to the appendix slide that answers our question…

Our Latest Show