The Pre-Start

Kinross reported record free cash flow of US$687m on Q3 production of 503koz at an AISC of US$1,622/oz. It has net cash of US$485m, while announcing the early redemption of its US$500m senior notes that were due in 2027 (K.TO) Up 7%

Albemarle posted a smaller-than-expected loss in Q3, while lowering its capex forecast to ~US$600m. Adjusted EBITDA was US$226m. It said it expects to generate US$300-$400m in free cash flow next year (ALB.NY) Up 4%

IAMGOLD hit a production record, driven by its Côté gold mine in Ontario, as its 3 assets produced 190koz of Au at an AISC of US$1,588/oz. Guidance (~780koz) left unchanged. Mine site free cash was US$292m (IMG.TO) Stock jumped 9%

African Rainbow Minerals said its jointly owned Beeshoek iron ore mine will be placed on care & maintenance after its sole customer ArcelorMittal South Africa ceased purchases (ARI.JO)

Larvotto announced PYBAR as its underground development contractor on a 4-year term (LRV)

Metro Mining shipped 735kwmt over October (down 5.5% month on month), leaving it on track to meet its revised guidance (MMI)

Toubani advised that operations at Kobada have not been interrupted despite events in Mali (TRE) Bouncing 15% up

Polymetals resumed operations at Endeavor following the recent fatal incident (POL)

Magnetic intersected a fourth new zone intersected at LJN4, hitting 17m at 3g/t from 497m amongst other results (MAU)

Santana announced that it has formally been granted the mining permit for Bendigo-Ophir for 30 years (SMI)

Carnaby reported assays of 8m at 2.8% CuEq (1.5% Cu, 1.5g/t Au) from 571m at Trek 1 (CNB)

Elementos announced a substantial upgrade in tungsten grades at its Cleveland project after further testing (ELT)

Many Peaks shared that gold recoveries averaged 94% from preliminary leach tests as it continues met work (MKP)

Geopacific shared assays from drilling at Great Northern, hitting 9m at 3.88g/t from 145m (GPR)

Cannindah hit 52m at 1.18% CuEq from 4m in a step-out hole at Mt Cannindah (CAE)

IGO appointed Vanessa Guthrie as non-exec director and Chair (IGO)

High Grade It

Miners are pressuring the Coalition to strike a deal with Labor on environmental approvals before Christmas, warning against any Greens alliance (Australian)

Ignore the lull, gold traders say this rally will run until next year (AFR)

Resources bosses have supported Indigenous ownership of mines, declaring procurement contracts alone will no longer be enough (Australian)

China’s largest state-owned bank plans to open a precious metals depository at Hong Kong Int’l Airport (Bloomberg)

Gold prices rose over 1% to US$3,984/oz as investors avoided riskier assets (Reuters)

Woodside warned that Australia is becoming a difficult place to do business, as it increasingly looks to the US and Mexico (Australian)

MMG’s US$500m purchase of Anglo American’s Brazilian nickel business has been hit by a European Union probe, regulators warning the deal threatens the bloc’s stainless-steel industry (Bloomberg)

Eagle Mountain signed an option agreement to re-acquire the Oracle Ridge mine, an amendment to potentially extinguish its debt, as well as receiving an NBIO from Nittetsu to earn an 80% interest in the consolidated project (EM2)

Black Canyon settled tenement acquisitions for land surrounding Wandanya & Balfour (BCA)

Rattlin’ the Tin

Kinterra Capital received a non-binding Letter of Interest from the US EX-IM Bank for US$200m in potential debt financing (Kinterra)

Trolius Gold announced a C$150m bought deal public offering as they advance the Troilus copper-gold project towards a construction decision (TLG.TO)

Blue Gold secured US$140m to restart the Bogoso & Prestea gold mine (BGL.N)

Aeris confirmed receipt of placement proceeds ($80m) and debt repayment (AIS)

Ramaco priced its US$300m of 0% convertible senior notes overnight (METC.N)

First Tin received a Letter of Interest from the US EX-IM Bank for up to US$120m in funding (1SN.L)

Word on the Decline

We’ve tried to verify this ourselves and have had mixed responses.. But we wouldn’t be surprised to see Grasberg take longer than the tentative plan put forward by Freeport already. Update due in two weeks.

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

‘Trumpette’ Billionaire Rinehart Wins Big From Rare-Earths Fight (Bloomberg Big Take)

Ray Dalio has penned a new article: Stimulating Into a Bubble (LinkedIn)

Jeff Quartermaine on jurisdiction risk & Chinese dominance (AFR)

Hallelujah (Arthur Hayes) We thought twice about sharing a crypto newsletter - but for those pondering gold, this is a very worthy read on the US govt’s intentions

Were you forwarded this email from someone else?

Today’s Top Tweet

We thought the same when we noticed the Lion Rock Minerals strategic placement last month was alluding heavily to a rare earth angle. Does anyone remember this article in the AFR a few years ago when Tronox had plans to build a REE refinery in Australia for a hot minute?

Tronox’s balance sheet is woeful though. Maybe Trump Bucks can fix that.

Devil’s in the Detail

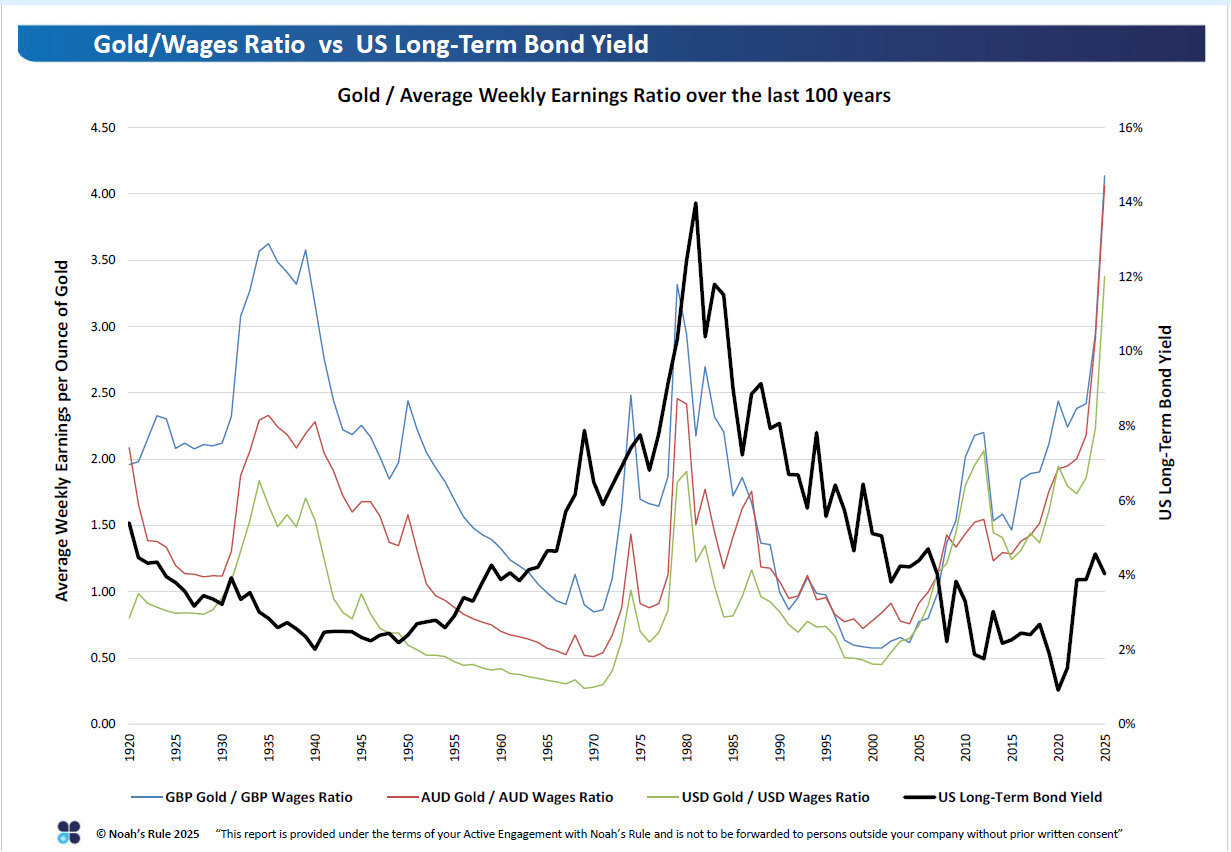

The average worker has to work 3.3 - 4.1 weeks to buy an ounce of gold in the US, the UK and Australia.

Now north of the 1980’s peak! What’s happened from the ~2011 high to now?

Credit: Noah’s Rule

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube