The Pre-Start

Capricorn closed out the last of its hedges, paying $50m, whilst purchasing put options exercisable at A$5k/ounce to mitigate a price drop (CMM)

NexGen received the regulatory all clear for 2025 site work (NXG)

Patronus copped a please explain note from the ASX after its stock surged 20% on no news, pointing to upcoming exploration results (PTN)

Vulcan Energy received permits to build a 30MW geothermal plant, as part of Lionheart phase 1 (VUL)

Santana noted that as part of its fast-track approvals submission, a group of ecological reports still require finalisation, delaying its submission timeline (SMI)

2 Brazilian authorities selected Viridis as a potential candidate to receive funding for its Colossus project (VMM)

During trade yesterday, Larvotto shared drilling results from the newly defined Golden Gate, intercepting narrowing, high-grade mineralisation (LRV)

Peninsula shared that it’s settled with Samuel EPC for US$4.75m, relating to its change to a fixed-price contract. The stock will remain suspended (PEN)

New Murchison published grade control drilling, confirming early mining bench grades (NMG) Up 17%

Great Boulder shared results from Ironbark, hitting 8m at 8.57g/t from 92m (GBR)

Euroz Hartleys announced a $23m capital return (EZL) 7% bounce

St Barbara shared a new presentation

High Grade It

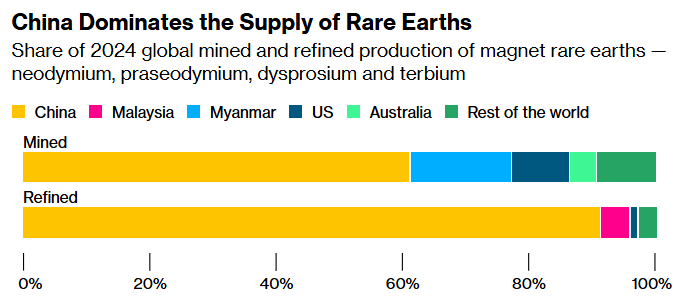

German manufacturers are increasingly struggling with supply bottlenecks for rare earths, calling on the EU to put more pressure on China (Reuters)

The Shire of Coolgardie’s plan to double mining rates has been officially shot down in a warning to cash-strapped regional councils (West)

Victoria has used more than 13% of its expected gas for energy generation for the entire year in just three days as breakdowns at a coal power plant and feeble renewable generation force it to rely on the fossil fuel (AFR) Staggering…

Tanzania plans to make it compulsory for large-scale miners to refine and trade at least 20% of their gold output domestically (Bloomberg) Should gold’s outperformance vs fiat continue, we struggle to see this trend fading

NSW Premier Chris Minns confirmed that his gov’t is in discussions with Tomago Aluminium over a potential rescue deal, amid mounting pressure (Australian) Is anyone surprised?

Wheelin’ n Dealin’

Adriatic is in trading halt regarding a deal-related update (ADT)

Metals X shared an update on its Greentech offer, noting that regulatory pre-conditions had been satisfied (MLX)

An 8% jump in New World Resources’ share price has investors looking at a potential interlopers (AFR)

Bunge is close to receiving a decision from Chinese antitrust authorities on its US$8.2B purchase of Glencore-backed Viterra (Bloomberg) Closing could net GLEN its needed US$1B

Brookfield has sold its 23% stake in Dalrymple Bay Infra., worth $428m, which’ll see the business gain ASX200 index inclusion with greater liquidity (Australian)

Teck and Sumitomo are locked in a commercial dispute over a major copper supply deal, exposing cracks in a decades-old pricing system (Bloomberg) Ultimately, another point of contention with Chinese strategy at its centre

Juno Minerals has agreed to sell the Mount Mason hematite project for $6m plus a 2% royalty to Gold Valley (JNO) plus current director of Juno Minerals, Yilun Chen is seeking to remove current directors Greg Durack and Patrick Murphy from the board via section 249CA!

Rattlin’ the Tin

Perpetua Resources secured US$425m in equity funding, with Paulson & Co taking US$100m (Mining.com) Stock down 20% on announcement

Ioneer confirmed its US$16m placement, targeted to see it to FID (INR)

Thesis Gold upsized its bought deal financing to C$24m (TAU.TO)

Awalé announced the closing of Fortuna’s strategic investment, which bought a 15% stake for US$6m (ARIC.TO)

African Gold completed the $9m strategic investment by Montage (A1G)

Terra Metals announced a $4m strategic investment from GEAR and Matt Latimore (TM1)

Word on the Decline

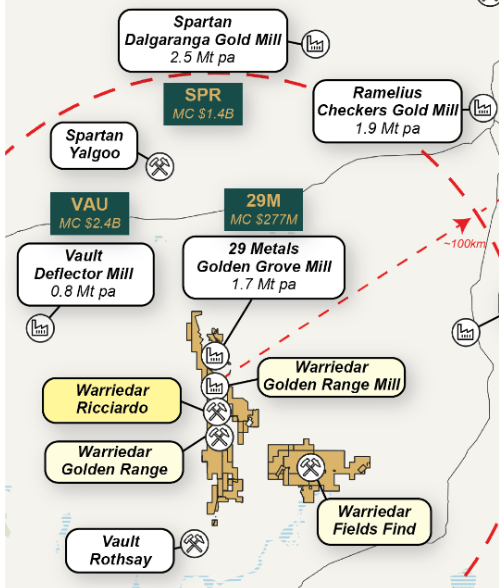

We reckon it’s worth thinking about the synergies amongst Deflector-Ricciardo-Golden Grove

Ricciardo needs a flotation circuit, good thing the two closest operating plants each have that

And while there’s more work to be done on the concentrate saleability, we think at least one of the neighbours is keeping a close eye on the deposit

Do you have some Word on the Decline? Reply to this email or shoot a message to [email protected] directly. We will always take your privacy seriously.

In the Weeds

Were you forwarded this email from someone else?

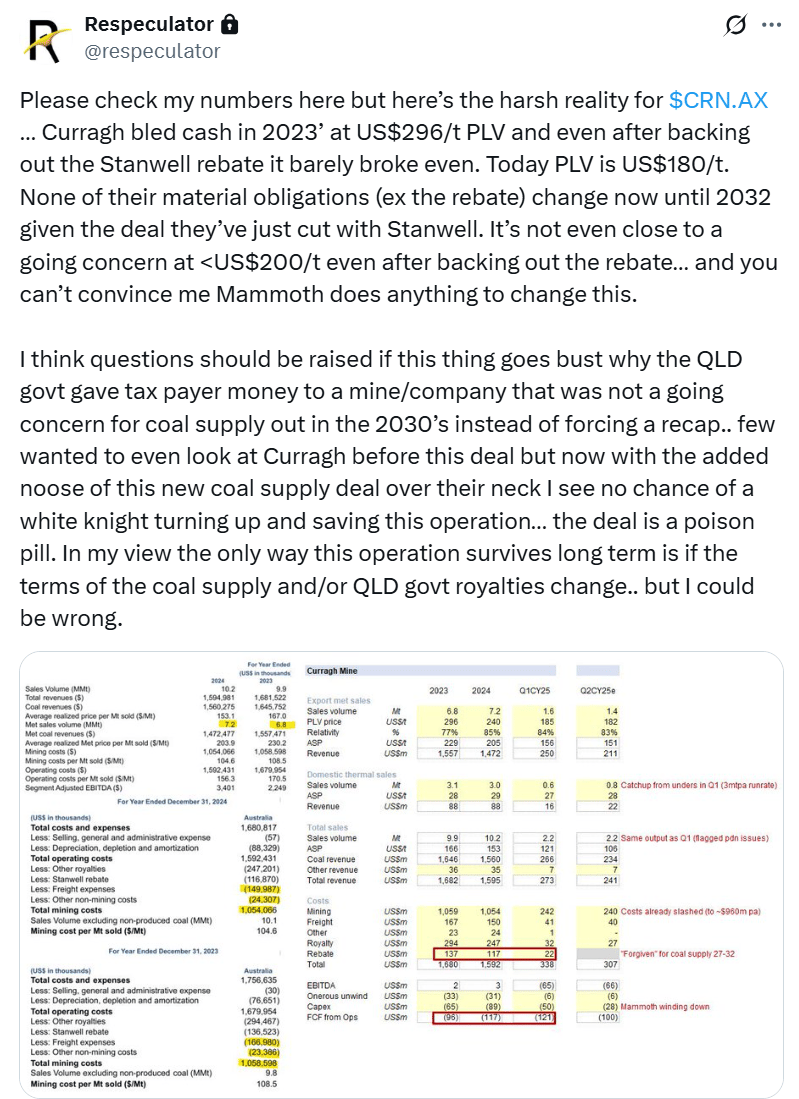

Today’s Top Tweet

Devil’s in the Detail

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube