The Pre-Start

Wheaton reported 2025 production of 692k GEOs, beating the upper end of guidance (670k), as a result of stronger performance at Salobo, Peñasquito, and Constancia. 2026 guidance is for 860-940k GEOs, while it forecasts growth to 1.2M GEOs by 2030 (WPM.NY)

Antofagasta reported full-year EBITDA of US$5.2B (up 52% year on year), with unit costs of US$1.20/lb (down 27%). Net debt sits at US$2.8B. Full year guidance of 650-700kt Cu was reiterated (ANTO.L)

Capstone forecasts 2026 copper production of 200–230kt, C1 cash costs $2.45–$2.75/lb, total capex $495m (sustaining $270m, expansion $225m) and exploration spend $70m (CSC) Softer than expected - down 16%

Nickel Industries Hengjaya mine received its 2026 RKAB quota, up from 9M wmt to 14.3M wmt, contrasting peers who’ve seen cuts (NIC) US$50m adj. EBITDA in Jan. Stock +5%

Iluka reported minerals sands revenue of $976, an underlying EBITDA margin of 31% and a loss after tax of $288m. Net debt stands at $473m, excluding non-recourse debt. It’ll pay a 3cps dividend (ILU) Eneabba commissioning in 2027

Elemental Royalty announced its inaugural dividend policy, targeting an annual payout of US$0.12/share. Qualifying shareholders may elect to receive dividends in Tether Gold tokens, backed by physical gold (ELE.V) Trend-setters?

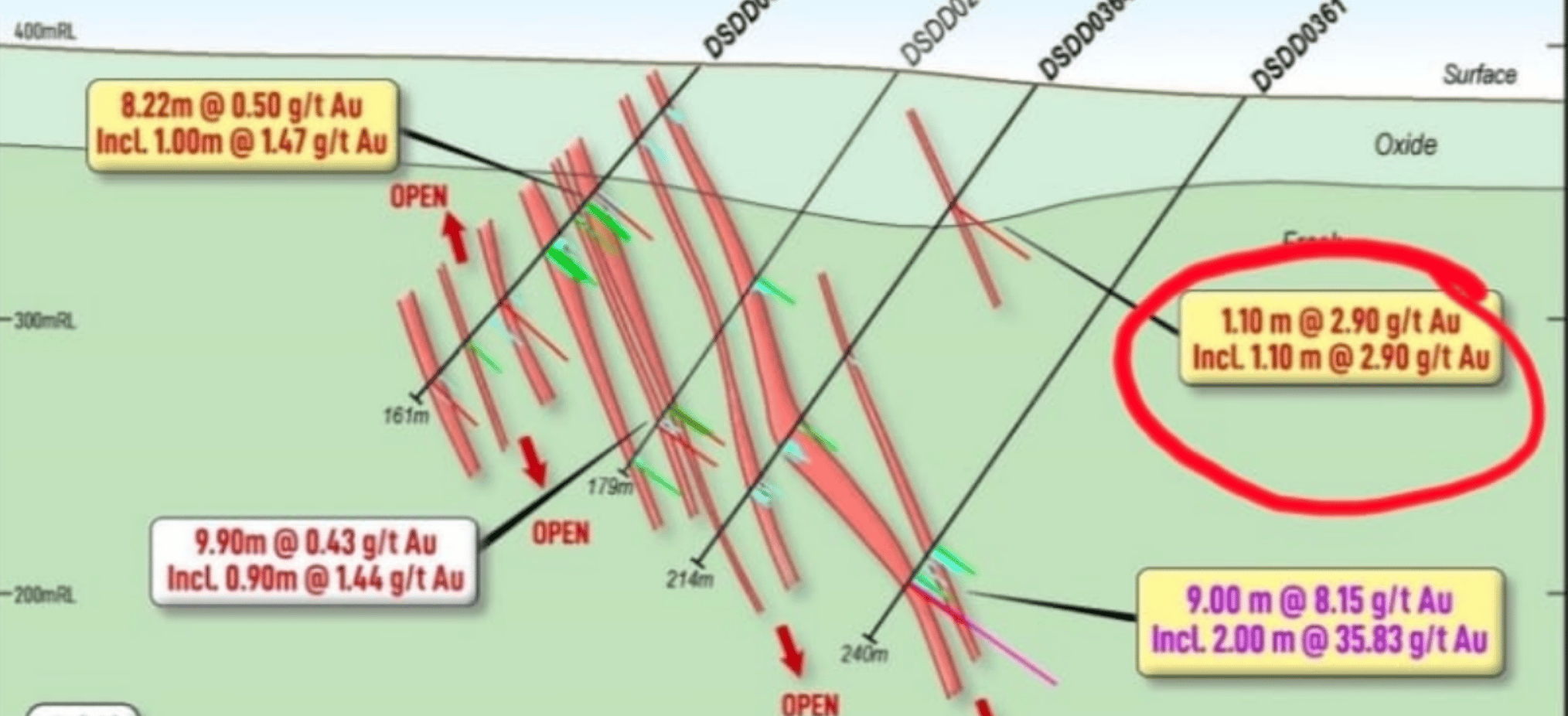

Catalyst’s drilling at Old Highway returned deep intercepts, including 26m at 5.9 g/t Au about 300m below the existing resource (CYL)

Brazilian Rare Earths reported Monte Alto drilling with intercepts including 28m at 19.4% TREO, and a ~350m strike extension to at least ~1.2 km (BRE)

Aeris retracted aspirational statements in its Peel acquisition doc’s, withdrawing +10-year mine life claims for Tritton & Jaguar and '1Moz Western Vein Field analogue' at Cracow, advising investors not to rely on them (AIS) Whoops!

Southern Cross Gold extended the Golden Dyke 200m west at Sunday Creek, intersecting 16 vein sets and returning 1.8m at 79.9 g/t Au (SX2)

Encounter reported drilling at the Green prospect (Aileron), extending niobium and REE mineralisation over 4km of strike. Updated MRE due Q2 2026 (ENR)

Strickland's drilling at Gradina intersected 61m at 1.9 g/t Au from 798m (inc. 31m at 2.7 g/t Au), confirming Gap Zone mineralisation outside the current resource (STK)

Kingston’s underground infill drilling at Southern Ore Zone returned hits, including 7.7m at 2.5g/t Au and 29.7m at 2.63% Pb (KSN)

Horseshoe Metals reported an exploration target for the Motters Zone at the Horseshoe Lights Cu-Au project of 2.6–3.6Mt at 1.0–1.5% Cu (HOR)

St George reported intersected 164m at 2.93% TREO and 0.39% Nb2O5 from surface (SGQ)

Magmatic AC program at the Weebo gold project returned multiple shallow gold intercepts, extending mineralisation along the 5km Ockerburry trend (MAG)

Celsius has appointed previoous non-exec Peter Hume as interim chair, (CEL)

Jake Klein sold 3.3m EVN shares, reducing his holding from 11m to 7.8m shares (EVN)

Greatland COO Simon Tyrrell has resigned, with Otto Richter acting in the role (GGP)

Celsius is exercising its rights to reclaim 60% of MMCI following Sodor failing to meet its funding deadline and appointing Peter Hume as interim Chair (CLA)

High Grade It

Gold was little changed near US$4,880/oz after a two-day decline, with many Asian markets offline for the Lunar New Year holiday (Bloomberg)

The United States will restart uranium enrichment in the U.S., partly with partners in France, Secretary for Energy Chris Wright stated (Reuters)

Australia is becoming an unlikely haven for foreign companies looking to raise money from the sharemarket, with miners the most likely to list in the near term (AFR) Glencore, Lundin Mining named

Kinross’ Great Bear project is getting fast-tracked under a new gov’t initiative to speed up mining development in the Canadian province of Ontario (Bloomberg)

What best describes you?

BlueScope Steel is considering a revised US$11B takeover bid ($32.25/share) from Steel Dynamics and SGH after rejecting a previous approach (Bloomberg)

Catalyst to acquire ~1,100sqkm of Bryah Basin tenements from Star Minerals and Albright Metals for $2.75m and $1.8m (plus $2.2m option). It’ll subscribe for a $1m placement in Star (CYL)

Billionaire Paulson sells stake in Trilogy Metals (Bloomberg)

Word on the Decline

Harmony remains very active on the M&A front in Australia, especially in Queensland (noting they announced FID at their Eva copper project there in November last year).

We also hear that CSA has underperformed since they took the keys last year.

We predicted Harmony’s acquisition of MAC Copper in 2025, let’s see if our hunch is on-the-money again this time…

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Australia’s X-factor saves the day, but for how much longer? (AFR) Up the miners! On a serious note, we (Australia) should address this…

Mike Henry’s BHP: Is the chief ready to exit the top job? (Australian) Stock hit an all time high yesterday

Simply the Best (Strictly Boardroom) Which ASX minerals and energy companies are ‘Simply the Best?

Were you forwarded this email from someone else?