The Pre-Start

Antipa reported further gold intersections at Fiama and Minyari, including 53m at 1.9 g/t and 28m at 1.9 g/t, with drilling ongoing & PFS ResDef completed (AZY)

Meeka reported Turnberry South RC drilling hit high-grade gold, including 8m at 14.79g/t from 44m (MEK)

Core Lithium updated the Grants mine plan and Ore Reserve, increasing it to 1.53Mt at 1.42% Li2O (up 44%), shifting to initial open-pit then underground and cutting pre-production capital by $35–45m (CXO)

Viridis received a non-binding letter of support from Bpifrance confirming Colossus’ eligibility for the GPS strategic financing guarantee, enabling DD and strengthening progress toward project financing and FID by Q3 2026 (VMM)

American Rare Earths released a preliminary Halleck Creek processing flowsheet and initial RCC optimisation results showing lower mass yield with similar TREO recovery to spirals, with comminution bulk testing planned (AAR)

IonicRE signed a non‑binding MOU with US Strategic Metals to deploy its magnet recycling technology at a fully permitted Missouri site to produce NdPr and heavy rare earth oxides (IXR)

Great Boulder’s Eaglehawk drilling hit 105m at 2.41 g/t Au from 95m, with further drilling planned (GBR)

Flagship noted that a key water pipeline, the Rute Este project, received EIS approval (FLG)

Orvana announced a US$25m prepayment & offtake agreement with Trafigura for its copper cathodes and doré bars to be produced at Don Mario in Bolivia (ORV.TO)

Marimaca announced the sudden passing of director Colin Kinley, honouring his contributions since joining the board in 2016 (MC2)

PC Gold has entered a trading halt on exploration results for its Spring Hill gold project (PC2)

New presentations were shared by Genesis, Antipa, Strickland, & Ballard

High Grade It

Australia’s gold miners are well-positioned if the rally in precious metals continues, analysts have said (Australian)

China has suspended a ban on approving exports of "dual-use items" related to gallium, germanium, antimony and super-hard materials to the U.S. (Reuters)

The gold surge has triggered a hiring spree at hedge funds, banks and dealers (AFR)

Aluminium traded near a 3-year high, as investors weigh the impact of a cap on production in China (Bloomberg)

Dyno Nobel has valued its Phosphate Hill mine and fertiliser plant at zero ahead of a 10-month period in which it has vowed to sell or shut the struggling but strategically significant asset (AFR)

The latest issue of Model Answer’s CFO Labs is out now! Check it out to find tutorials, write-ups and heaps of useful tools to sharpen your mining & financial knowledge.

Botswana & Angola played down the prospect of a fight over De Beers after both previously said they’d seek a majority equity share in the company (Bloomberg)

Wheaton Precious Metals has acquired a gold stream on the Spring Valley project in Nevada from Waterton Gold for US$670m (WPM.TO) deposit $670m, 8% gold until 300koz, then 6%. Production payments 20% of spot price.

Barrick completed the sale of Alturas to Booroo for US$50m and a 0.5% NSR (B.NYSE)

Rattlin’ the Tin

Serra Verde received backing of up to US$465m from the US Int’l Development Finance Corp for its Pela Ema rare earth project in Brazil (FT, Mining.com) Private Serra Verde’s shareholders include Denham Capital, the Energy and Minerals Group of Houston and Mick Davis’ Vision Blue

ASP Isotopes’ uranium-enriching arm is offering convertible notes in a deal that has drawn the backing of Eric Trump and Donald Trump Jr (Bloomberg) dubbed ‘Quantum Leap Energy’ and valued at US$400m pre-money, raising US$100m

Word on the Decline

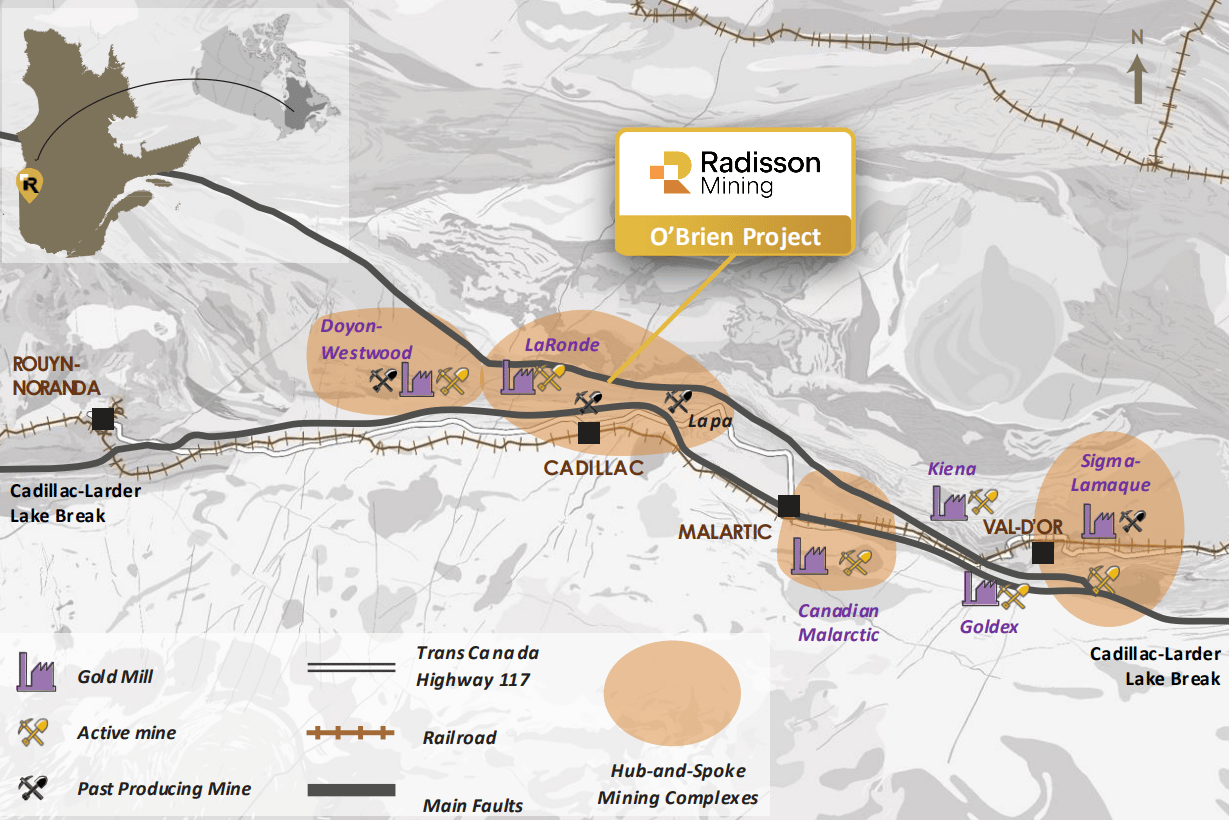

IAMGOLD’s move on Northern Superior last month might not be the final bolt-on act from IAMGOLD this cycle. The same reader who tipped the Northern Superior move ~6 months in advance thinks the gold miner is a fair chance of moving on C$330m Radisson Mining as well.

Raddison is already linked via an MOU to use IAMGOLD’s Doyon mill only 21km away. Toll-milling is baked into its PEA numbers. Agnico’s LaRonde is a touch closer and presents a plausible milling option too.

Source: Radisson Mining

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

America is rebuilding its rare earth supply chain - but killing demand (Henry Sanderson)

It’s the most strategic commodity on Earth (that no one wants to fund) (AFR Chanticleer)

Anglo-Teck gatecrashers should bide their time (FT) A better chance will come closer to close

Law firm in Rinehart’s huge royalty battle acquired (West) Cullen Macleod has taken over boutique commercial firm Taylor & Taylor

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

Company name changes remain a great commodity contra-indicator. What could be more pro-cyclical?

But with SPD shareholders pushing back on this one, we’ll have to wait a bit longer for Palladium outperformance vs Platinum…

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube