The Pre-Start

Glencore reaffirmed its goal of producing 1Mt copper by 2028 at its CMD, going up to 1.6Mt by 2035. Capital intensity at $16.6 k/CuEq tonne. Alumbrera will restart in Q4 2026 (GLEN.L)

Ivanhoe shared that 2026 & 27’ guidance will be between 380-420kt and 500-540kt Cu, respectively, with a medium-term target of 550ktpa. Kakula Stage 2 dewatering is currently 60% complete (IVN.TO) Up 9%

Ramelius and the Kakarra Part B native title holders signed a mining agreement for the Rebecca-Roe project (RMS)

Pantoro confirmed extensional drilling at Scotia has intercepted high-grade mineralisation up to 135 metres below the current indicated resource (PNR)

Orezone reported grade control drilling while sharing that Bomboré’s hard-rock plant commissioning is advanced, with first gold expected soon (ORE)

Global Lithium’s Manna DFS reports a post-tax NPV8 of $472m, IRR 25.7%, $439m pre-production CAPEX, a 19Mt ore reserve at 0.91% Li2O and a 14.3-year LOM, targeting FID in 2026 (GL1)

Q2 Metals intercepted 457m at 1.65% Li2O from 187m (QTWO.TO) Up there with best spodumene hits recorded - stock up 10%

Prospect identified a new high-grade zone at Mumbezhi, returning 34m at 0.88% Cu from 128m and 2.7m at 0.52% Cu from 114m (PSC)

Santana reported high-grade drill intercepts at RAS North Honeypot, including 8.7m at 30.6g/t Au, extending the HG1 zone at least 230m down-plunge (SMI)

Lotus reported Kayelekera is ramping to steady state by Q1 CY26 after Nov processing averaged 138 t/h and ~83% recovery; Cash was $74m at 30 Nov (LOT)

New Murchison reported Crown Prince produced 67kt at 3.69 g/t Au, with 7.6koz recovered and a $42m payment received for October sales (NMG)

Metro Mining shipped 783Kwmt in Nov, 6.5% above Oct, with YTD shipments of 5.6Mwmt and on track for 6.2–6.6Mwmt for CY25 (MMI)

Meeka hit 23m at 1.05g/t from 76m in exploration drilling at Rosapenna (MEK)

Broken Hill ramped up Blackwoods mining and processing, reporting significant extension results, hitting 3m at 1,426g/t AgEq outside the current MRE (BHM)

True North has commenced a right-sized PFS for the Cloncurry copper project (TNC)

Lefroy shared that an initial 21kbcm of pre-strip waste has been mined, with first ore anticipated to be exposed this month (LEX)

BlackRock reduced its holding in Sheffield 6.8% to 5.7% (SFX)

A new presentations were shared by Astral, Estrella & Ore Resources

High Grade It

Rare earths start-up Vulcan Elements has won funding from the Pentagon, 3 months after Donald Trump Jr’s VC firm invested in the company (AFR)

Chinese copper smelters, faced with the prospect of negative fees, are in stalemate with a major Chilean miner in talks to set the benchmark (Bloomberg)

The first commercial shipment of iron ore from Rio Tinto’s new Simandou JV mine in Guinea is on its way to China (West)

Glencore will design & possibly develop a new copper smelter in Chile, after being selected by Codelco (Bloomberg)

Jefferies said term contracting volumes for uranium surged in the last 6 weeks, through November, erasing months of sluggish activity (TV)

Ensure safe, compliant working conditions on every shift - onsite atmospheric and noise exposure monitoring by Bar Health & Hygiene. Don’t leave it to chance. Get in touch with Brenton.

Mt Gibson has received FIRB approval for its acquisition of a 50% interest in the Central Tanami project (MGX)

Glencore said it would seek to keep an equal share of its copper JV with Anglo American in Chile, should QB and Collahuasi merge (Bloomberg)

Kula Gold recommends shareholders accept Forrestania’s off-market takeover offer of 1 FRS share for every 5.6 KGD shares (KGD)

China National Nuclear Power saw its shares triple on its Shenzhen debut after raising US$570m (Mining.com)

Locksley is raising $15m at 24c (LKY)

Andean Silver is raising $30m at $1.85 (ASL)

Osisko Metals announced a C$33m placement, with Hudbay, Agnico and Franco-Nevada all participating (OM.TO)

FireFly completed a $139m raising to fund Green Bay (FFM)

Felix Gold is in a trading halt pending a placement (FXG)

True North Copper is raising $10 at 50c (TNC)

Sunstone is in a trading halt as it has launched a capital raising (STM)

We are back with Xmas Drinks open to all on Tuesday 16 December from 5pm at BrewDog Perth.

Half of Perth will already be on leave, the other half can come grab a beer and talk about mining stocks all night.

RSVP & add to your calendar 👉 https://calendarlink.com/event/9FJi5

Word on the Decline

We know there are about 6 Ecuadorian project companies that are all suggesting they are near-term acquisition targets….

But in the case of Titan Minerals, their recent 9.9% strategic investor, Lingbao Gold just completed a HK$1.17B zero-coupon bond issue.

And the stated use of proceeds? “will be used primarily for overseas gold-asset acquisitions”

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Mining (Kopernik) Yearly required reading [Part II]

Congo's attempt to control cobalt market risks becoming supply shock (Reuters op-ed)

The hunt for copper to wire the AI boom (FT’s Big Read)

From a "Boomer Mining Stock" to a "Ponzi Mining Stock" (Le Shrub) Ivanhoe Electric

Feudalism (Praetorian Capital)

A glimpse inside BHP Ventures' bets on the future of mining (CB)

Good enough for NY, why not Perth? Rinehart’s argument for a helipad (AFR)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

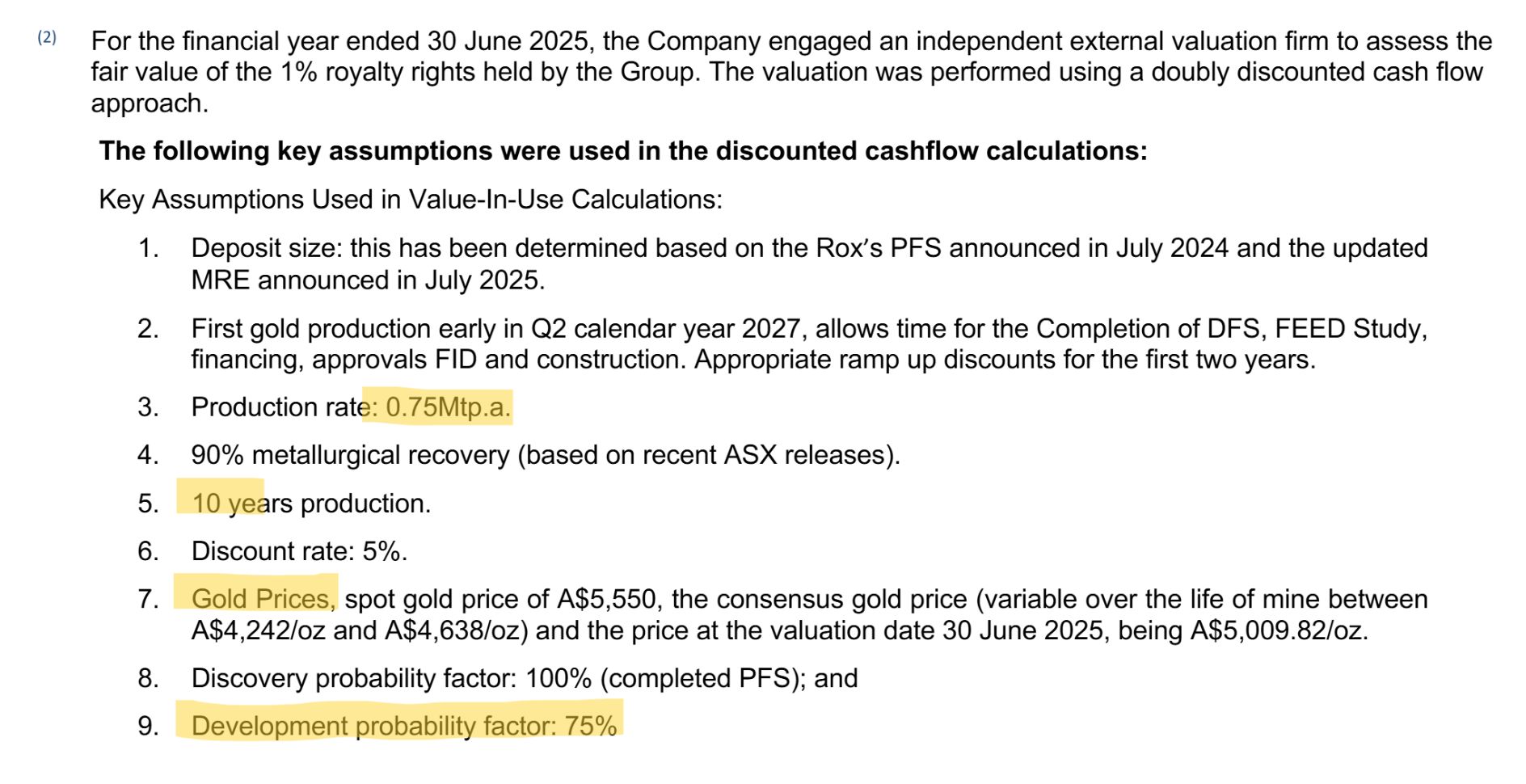

The current 17cps on-market takeover of VMC by Christopher Wallin’s QGold has captured our attention. The valuation of Venus’ royalty over Youanmi is 12.3cps alone based on the “independent valuation in Venus’ annual report”

But take a look at the assumptions in that valuation. Initial production rate will be 0.9Mtpa and expected to grow per Rox’s DFS. The gold price is conservative. Development probability should be 100% not 75% now Rox has largely equity-funded most of the capex.

All to say, the real value of this royalty is much more than 12.3cps. We think it’s closer to 20cps. And then throw in the 10.4cps of RXL shares that Venus owns. Another 2.5cps of cash and other assets that Venus owns.

No wonder Wallin is being opportunistic right now.