The Pre-Start

Newmont reported quarterly adjusted EBITDA of US$3.3B and adjusted net income of US$1.9B on production of 1.4Moz Au + 35kt of Cu. Free cash flow was US$1.6B, while it returned US$823m to shareholders (NEM) Down 3%

Freeport announced Q3 production of 912Mlb Cu & 287koz gold for operational cash flow of US$1.7B. It spent US$1.1B on capex and closed with net debt of US$1.7B (FCX.NY)

Whitehaven announced ROM production of 9Mt (down 15%) and coal sales of 5.9Mt (down 1%), while making its first contingent payment of US$9m to BMA. It averaged prices of $200/t and $175/t across QLD & NSW. Net debt closed at $0.8B (WHC)

PLS produced 225kt of SC5.3, with the average grade mined down to 1.2% Li2O. Recoveries picked up to 78.2%. It realised a price of US$841/t (SC6) with a unit operating cost of US$422/t (CIF). Cash fell 13% to $852m (PLS) Up 5%

Antofagasta reported a 1% rise in Q3 copper production, and said it expects annual output at the lower end of its forecast range of 660-700kt (ANTO.L)

Mt Gibson shared that remediating the rockfall at Koolan Island is not viable, with stockpiles to be processed and rehab to accelerate. Transition cost will be $30-40m (MGX) Down 25%

Coronado responded to media speculation, confirming there was a minor roof fall at Buchanan, which did not amount to a “coal seam collapse” (CRN)

Lockheed Martin has secured up to 25% of Syerston scandium production over the first 5 years, after negotiations with Sunrise (SRL)

G Mining has approved formal construction decision at its Oko West mine in Guyana, with initial capex penned at US$973m (GMIN.TO)

Black Cat shared assays from Big Sarah, hitting 3m at 2.62g/t from 86m in a 14-hole program (BC8)

Tamara Brown has retired from 29Metals board, as Nick Cernotta was added (29M)

Zeta Resources has gone substantial on Siren Gold with a 7.5% stake (SNG)

High Grade It

An iron ore alliance between BHP and Rio Tinto to protect their interests in WA and counter the threat posed by China’s determination to drive down prices is not unthinkable, according to BHP (Australian)

BHP sold several iron ore cargoes to Chinese traders this week, despite a dispute with China's powerful state buyer CMRG (Bloomberg)

Draft new environmental legislation will include a provision that requires developers to achieve a “net gain” for the environment (Guardian)

The US government has invested in a new fund to invest in critical minerals alongside Orion & Abu Dhabi’s ADQ, targeting an ultimate size of US$5B (Bloomberg)

Coronado continues to keep the market in suspense on whether it can continue trading, as investors remain in the dark over details surrounding talk of a coal seam collapse (Australian) See the company’s response (CRN)

The U.S. & China are battling to project power and “just flexing muscles” as they compete to secure critical minerals supply, the new chair of BHP said (Reuters)

M23 rebels denied accusations that its fighters had looted at least 500kg of gold bullion from Twangiza Mining’s gold concession in eastern DRC (Mining.com)

BHP has opened its books to potential buyers of its struggling nickel operations, with gold miners and private equity groups examining the $1B+ portfolio (Australian), apparently gold tenements to fetch $100m while the nickel concentrator could fetch less than $100m

Fortescue is emerging as the frontrunner to acquire a 49% stake in a Spanish solar power portfolio owned by Iberdrola, valued at €900m (Bloomberg)

David Geraghty led Forrestania Resources is requisitioning shareholders of TG Metals via section 249D. TG Metals’ response shows an indicative proposal was made by Geraghty for an all-share acquisition of TG6 at an implied price of $0.318 per share (TG6)

Rattlin’ the Tin

Northern Minerals isn’t passing up an opportunity to raise cash from its rising share price, hitting up institutional investors for $60m (West)

Perenti has refinanced its existing syndicated debt facility with a new $650m facility on “improved pricing and terms” (PRN)

Pivotal Metals secured a $5m raising to drill at Belleterre (PVT)

Dolly Varden closed a C$34m bought deal financing (DV.V)

Atex Resources upsized its raising to C$96m to advance its Valeriano project in Chile (ATX.V)

Word on the Decline

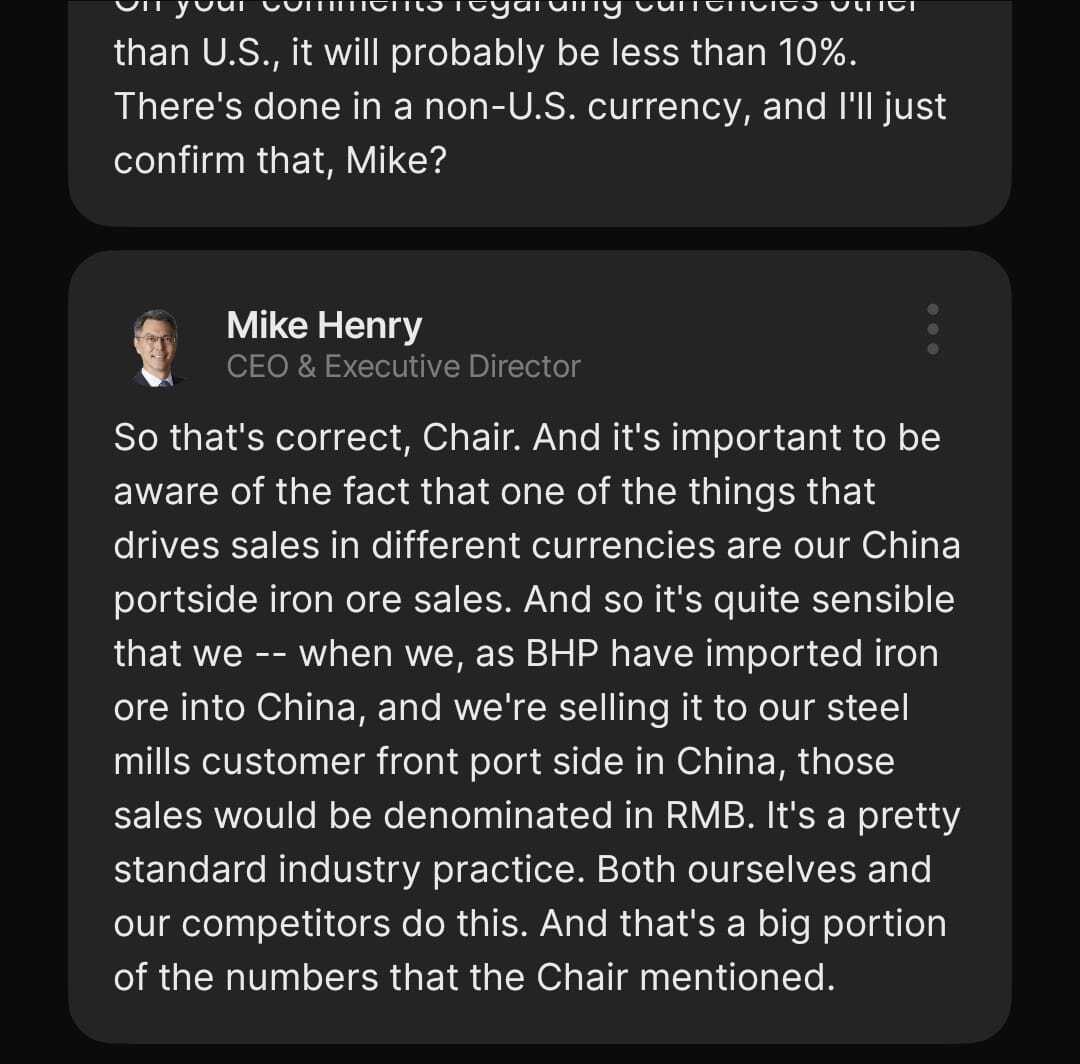

BHP was asked directly at their AGM yesterday what percentage of total sales are sold in another currency. It’s worth listening to the response if you’re still paying attention to the RMB story. But here’s Mike Henry’s words on the matter.

We’ll have more to say on this in time. We don’t believe it is as insignificant as BHP is portraying.

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Nothing like a big prize to stir a Rio Tinto razzle-dazzle play (AFR Chanticleer)

MacroVoices #503 Adam Rozencwajg (MV) Gold, Oil & Uranium

The country’s iron ore giants are walking a tightrope with Beijing (AFR) Good read on the multi-faceted engagement between the Majors & China

China’s quest to engineer the future with Dan Wang (Hidden Forces podcast)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

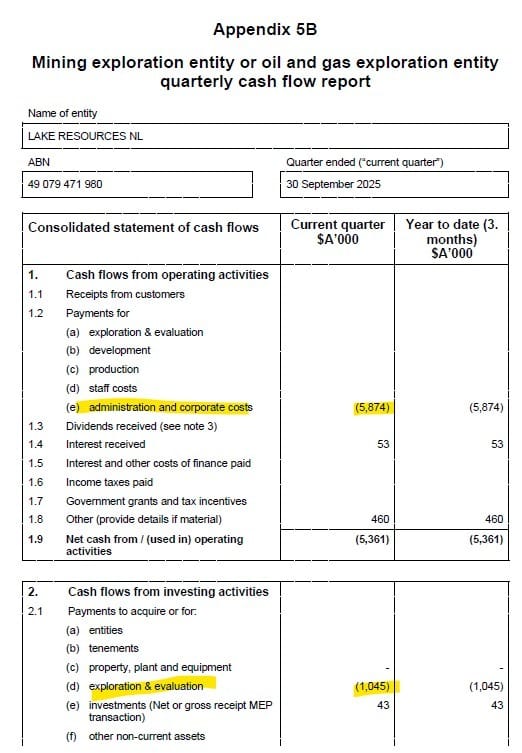

Industry-leading ratio of G&A to exploration expense…

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube