Today’s note is the final Director’s Special for 2025 – we’ll be back in action on January 19. Thanks to all the Money Miners for a massive year – we’re excited to see what 2026 brings

The Pre-Start

Develop was awarded a $200m, 5-year underground development contract to establish access tunnels at OceanaGold's Waihi North gold project, with mobilisation to start ahead of works beginning in H1 2026 (DVP)

Coronado reported a fatality at Logan in West Virginia, temporarily suspending operations while investigations occur (CRN)

Global Lithium signed a non-binding MOU with Southern Ports to assess export logistics for up to 240ktpa of spodumene con from Manna through Esperance (GL1)

Aurum reported multiple diamond drill intercepts at BMT3, including 10.2m at 6.05 g/t Au from 126m (AUE)

PTR completed 446 AC holes for 9,388m at its Rosewood titanium project; initial assays include 31m at 13.5% HM from 8m. A resource is expected Q2 2026 (PTR)

Viridis is in a trading halt regarding its preliminary licence approval process (VMM)

Hillgrove completed the Nugent decline connection to the Kavanagh mining area at Kanmantoo, supporting an increase to 1.7–1.8Mtpa in H1 2026 (HGO)

McGrathNicol has been appointed as Voluntary Administrators to Mineral Commodities (MRC)

Legacy Iron Ore has ceased mining and development at Mt Celia, marking the completion of phase 1 mining (LCY)

Felix Gold appointed Blair Way as director, while Mark Strizek retired (FXG)

Ninety One emerged as a 5.7% shareholder in Astral (AAR)

High Grade It

Australia has upgraded resource export forecasts by $34B after Trump’s tariff less damaging than feared, with gold & iron driving the recovery (Australian)

The national budget has received a turbocharged revenue boost from higher inflation, rocketing gold prices and the AI-driven sharemarket boom (AFR)

The euphoria pervading lithium markets hit fever pitch this week after China revoked 27 expired permits in its major mining hub (AFR)

The tax office has been given limited access to court documents in its probe of Chris Ellison over alleged misuse of company resources & tax issues (Australian)

Simandou is laying off thousands of workers, as construction moves to ramp up (Reuters)

EDF raised its cost estimates for the 6 nuclear reactors it plans to build in its home country by 8% to €73B, as labour & raw materials costs rise (Bloomberg)

Brian Gilbertson, the South African exec who marshalled Billiton’s merger with BHP, has died at the age of 82 (AFR)

An Indonesian state-owned enterprise is weighing another run at Dyno Nobel’s Phosphate Hill mine and fertiliser plant (AFR)

Boab has exercised its option to acquire its JV partners’ 25% interest in Sorby Hills silver-lead project for $12.5m plus deferred payments of $10.5m (BML)

Macro Metals completed the acquisition of a 27.3% interest in the Extension iron ore project to enable up to 4Mtpa exports from Q4 CY26 (M4M)

First Majestic announced it’ll sell its Del Toro Silver mine to Sierra Madre Gold & Silver for up to US$60m, with US$30m to be paid upfront (AG.NY)

Sheffield said Orion and NAIF agreed a waiver and deferral of December 2025 interest and principal payments and covenant waivers for the Thunderbird mineral sands mine’s senior secured facilities, while discussions continue (SFX)

Rox upsized its oversubscribed SPP to $18m, with the placement plus SPP to provide $218m to fund Youanmi’s equity component (RXL)

Aeris 45c SPP, targeted to raise $10m, was oversubscribed with $21.6m, with the company electing to accept all applications (AIS)

Burgundy has secured an up to C$115m loan from Canada’s LETL program, enabling continued operations, balance sheet restructuring & development of better deposits (BDM)

The US EXIM Bank has offered loans of up to US$2B to Graphite One for its Alaska-to-Ohio supply chain (GPH.V)

Nova Minerals is pricing an offering of US$20m to advance its Estelle gold project (NVA)

Word on the Decline

If the deal hasn’t been announced yet, the odds of seeing it before next year are slim. The Money of Mine M&A Rumour Mill is off til Jan.

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Aussie Fund Manager Performance November (MrQuick)

Sigma Lithium (Truth Below Ground) 70-page research report

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

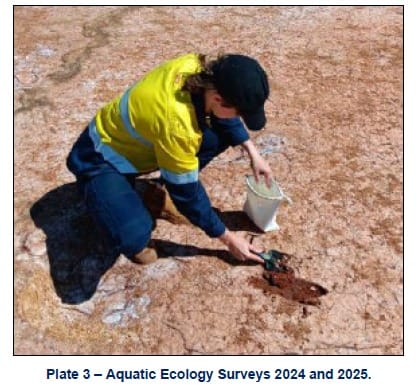

No fish here…

Our Latest Show