The Pre-Start

Ora Banda shared results from the first 9 holes at Waihi, with hits of 13.5m at 6.1g/t from 113m and 8m at 8.7g/t from 80m being the standouts (OBM)

Meteoric received formal approval to construct and operate a rare earth pilot processing facility, costing $2m, with operations commencing by October (MEI)

Aris Mining shared a PFS for Soto Norte in Colombia, with an NPV5 of US$2.7B, IRR of 35% and 2.3 year payback on 22 years of mine life, producing 263koz of gold on average from years 2-10 (ARIS.TO)

Larvotto released Eleanora intercepts, with a headline hit of 28m at 5.7g/t from 186m (LRV)

Centaurus has been advised of required upgrades to transmission capacity in order to meet Jaguar demands, with the timeline consistent with CTM’s’ (CTM)

Emmerson shared assays from White Devil extensional drilling, with a best hit of 15m at 6.8g/t from 49m (inc. 2m at 46g/t) (ERM)

Sunstone published assays from drilling at 2 prospects within Bramaderos, amidst corporate and asset discussions (STM)

Many Peaks shared results from 11 diamond holes at Ferké, with each hole returning significant intercepts, with hole 67 delivering 85m at 3g/t from 295m (MPK)

Brightstar shared assays from 6,400m of RC and diamond drilling, targeting infill and extensional resources at Yunndaga within Menzies (BTR)

Black Cat has added Amber Rivamonte to its board as an independent non-exec director (BC8)

Haranga shared an update on Lincoln gold project, with dewatering running at maximum rates and drilling underway for a end of year resource target (HAR)

High Grade It

Gold producers are defying a broadly gloomy week on the Aussie market and surging on a long rally, with industry leader Newmont up 90% year-to-date (AFR)

Fortescue exec Gus Pichot flew to Gabon to reassure its leaders about the company’s commitment to the Belinga iron ore project, after slow progress (Australian)

MinRes has been accused of work safety breaches after latest WA truck crash, following whistleblower allegations (AFR)

Teck is deferring major growth projects to focus on fixing issues at its Quebrada Blanca, with a review focused on improving tailings drainage (Bloomberg)

Goldman has said gold could surge to US$4500/oz on growing fears of stagflation (AFR)

Swelling US demand for electricity has the potential to boost coal consumption as much as 57%, according to Peabody (Bloomberg)

IMARC Sydney is just 7 weeks away, kicking off on October 21st. Investors attend free – register today before tickets are gone! We will be there too

Wheelin’ n Dealin’

Brazil opened a probe into Anglo American’s US$500m nickel sale to MMG, with Turkish company CoreX launching an objection to the deal (FT)

Anglo is seeking buyers for its US$2.5B (19.9%) stake in Valterra, just three months after spinning off the platinum business (Bloomberg)

Elemental Altus Royalties paid A$80m for a royalty portfolio cornerstoned by Genesis’ Laverton project (ELE.V)

Austral reported finalisation of its Glencore agreement for the acquisition of Rocklands, with offtake, tolling & funding agreed (AR1)

Rattlin’ the Tin

Word on the Decline

If you’re the sort of person who punts on M&A anticipation, here’s an interesting thought to entertain: What will Jake Klein buy?

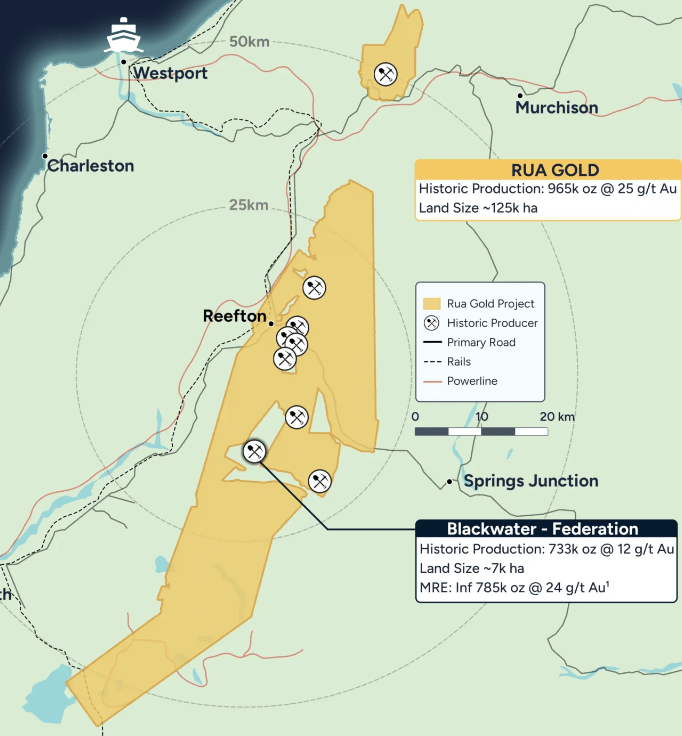

We know his focus will be driving Endura Mining, the New Zealand gold developer, majority owned by Australian Super, previously called Federation Mining

And we expect Jake to do what he has always done: deals

Do you have some Word on the Decline? Reply to this email or shoot a message to [email protected] directly. We will always take your privacy seriously.

In the Weeds

Forget the pricey coffee, the inflation fight is won and done (AFR) A thought-provoking read, which feels contrary to what we’re seeing/hearing

The big threat to Australia’s iron ore empire (AFR) Outlines Vale’s grade threat

Nickel in a pickle that White House will struggle to reverse (FT)

Four Chinese car brands in top 10 in Australia for first time (AFR) Who’d of thought that price (& quality) wins out

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

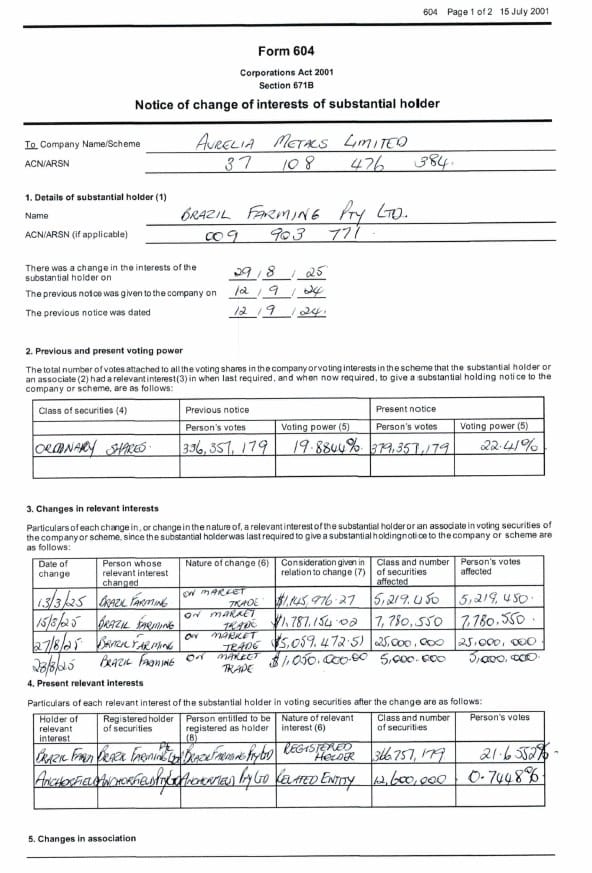

There is no bigger flex than a handwritten sub notice

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube

Gold Miners That Actually Compound (Greg Orrell)

Stocks covered: AEM.NY, B.NY, NEM, AUC, CYL, STN, IAG.NY, LUG.TO, ARTG.C, ORE, WAF, RSG, AAUC.TO