The Pre-Start

Sandfire produced 24.6kt copper and 22.2kt zinc in the quarter, led by higher grades at both MATSA and Motheo. Net debt reduced a further US$61m to US$62m (SFR)

Perseus grew its cash & bullion balance by US$10m to US$837m, plus US$134m in listed securities. It produced 100koz at US$1,463/oz, leaving guidance unchanged (PRU)

Greatland Gold produced 81koz gold and 3.4kt copper in the quarter at an AISC $2,155/oz, closing the period with $750m cash (GGP)

Ramelius produced 55koz gold in the quarter, lower than analyst estimates, as Cue grades return to average and Penny grade rolls over (RMS) 5-year outlook to be released tomorrow. Down 6%

Pantoro produced 19.6koz gold in the quarter but reiterated FY26 guidance 100-110koz (requiring 27koz per quarter for the remaining 3) and closed with $182m in cash and gold (PNR)

Vault produced 91.5koz gold in the quarter at AISC 2,613/oz, closing with A$701m cash, having deployed A$9.3m in the buyback program so far (VAU) 12 months until unhedged

MinRes has triggered the contingent payment of $200m payable by MSIP after shipping 8.75Mt iron ore from Ashburton since 1 August (MIN) 35Mtpa nameplate

Lindian commented that it remains unaffected by reports that Malawi has banned exports of raw minerals out of the country (LIN)

Boab announced the commencement of early works at Sorby Hills (BML)

Sprott trimmed its stake in Sovereign Metals by ~7m shares since June (SVM)

Firefly published more assays from Green Bay, claiming the latest results point to 800m mineralisation with substantial widths (FFM) headlined by 43m at 7.6% CuEq

Aurum shared further assays from Boundiali drilling, hitting 11m at 3.2g/t from 336m (AUE)

Lion Rock Minerals has entered a trading halt pending the release of exploration results for its Minta rutile project in Cameroon (LRM)

MLG has appointed Mark Hatfield as Acting CEO effective immediately (MLG)

Ron Mitchell has been announced as the new CEO of Firebird (FRB)

High Grade It

Trump will look to sign economic agreements and critical minerals deals with trading partners during his trip to Asia (Bloomberg)

The EU is seeking to speed up critical minerals partnerships with countries such as Australia, Canada, Chile, & Kazakhstan to reduce China reliance (Reuters)

PLS said bad and unintended consequences could result from a government plan to set minimum price floors for the battery mineral, and taxpayer funds may be better spent on shared infrastructure (AFR)

A Rio-controlled company in Mongolia has asked police to help with a “comprehensive internal investigation” into allegations of corruption (AFR)

Despite Tuesday’s gold drop, dealers from Singapore to the US reported a rush of buyers, with some having record sales (Bloomberg)

Trump reversed a Biden-era air pollution rule that had imposed stricter limits on emissions from copper smelters (Reuters)

Trading houses, hedge funds and banks are hiring specialist gold traders as interest in the metal soars (Bloomberg)

JP Morgan analysts maintained a bullish outlook on gold, forecasting a long-term target of $6,000 by 2028 (Reuters)

Check out the latest edition of CFO Labs, by Model Answer, to get your hands on free tools like tutorials on how to get your mine funded and mining M&A dashboards!

Newmont is studying a potential deal to gain control of Canadian rival Barrick’s prized Nevada gold assets, people with knowledge of the matter said (Bloomberg)

Tether has acquired an 8.1% stake in Gold Royalty Corp, according to a 13D filed on Friday (GROY)

Angola has offered to buy Anglo American’s majority stake in De Beers, other suitors include neighbouring Botswana and groups led by former De Beers executives (Bloomberg)

Aeris has struck a deal to divest its North Queensland copper assets for up to $15.5m to Dingo Minerals (AIS) consisting of release of $6.5m environmental bond, ~$5m cash and deferred cash $3m upon commercial production

Rattlin’ the Tin

Ivanhoe Atlantic wants to raise about $300m to fund the development of the Kon Kweni project in Guinea, eyeing an ASX listing (AFR)

Medallion Metals has selected Trafigura to provide a US$50m facility together with 7-year offtake agreement to fund the development of the Ravensthorpe mine and processing at Forrestania (MM8)

Challenger Gold raised $30m, the plant now operational and processing Casposo stockpiles (CEL)

Coda Minerals raised $12.3m, suggesting its Elizabeth Creek PFS is now funded to completion (COD)

Word on the Decline

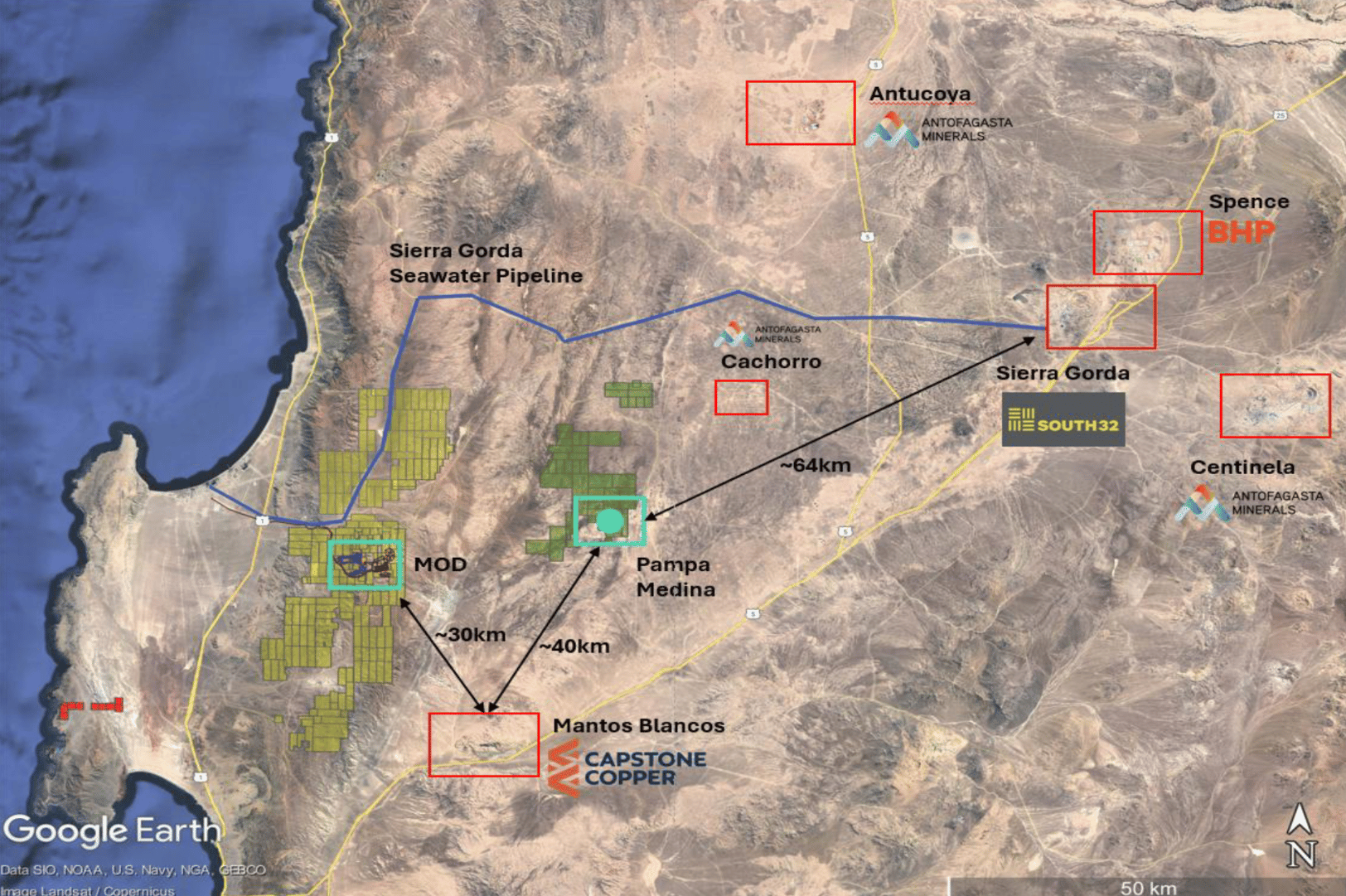

As the copper market tightens, we turn our eyes to projects that present a glaring takeover rationale. Marimaca is a clear standout

A shovel-ready Chilean oxide project with near-term cathode, low strip, and capital intensity that screens well against peers and producing ~50 ktpa copper cathode, for relatively modest upfront capex ~US$587m…

What gets us particularly excited are the shareholder dynamics. Private equity group Greenstone sits as the anchor with ~22% stake which can be partially dealt to ignite a competitive dynamic (think RCF selling its New World stake to Kinterra as the latter went head-to-head with CAML)

Assore now has ~18.9% after entering in 2024 by paying a premium, securing a board seat and pro-rata rights. A well-capitalised strategic with board access is a credible lead bidder

The setup is primed for a competitive auction with commodity tailwinds. And we haven’t even mentioned regional synergies…

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Inside the ‘Rudd ramp’: the frenzy to ride the rare earths wave (AFR) Behind the scenes on the US-Aus $13B deal

"It's all the same Trade" (Le Shrub) “So when GOLD trades in line with the king of meme stocks, OKLO, you can tell that something is wrong”

Australia’s rare earths bonanza has everything except a market (AFR op-ed)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

When you’re a few hundred kilometres away from Mountain Pass, you’ve got to get clever about the marketing…

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube