The Pre-Start

Liontown signed a binding offtake agreement with Canmax for 150kwmt pa of spod con in 2027 & ‘28, priced by formula referencing concentrate indices (LTR)

Kingsgate met the Thai Deputy PM & 27 gov’t representatives to discuss cooperation on Chatree, its social and economic impacts and engagement after the TAFTA arbitration termination (KCN)

G Mining was granted a mining license for Oko West in Guyana (GMIN.TO)

Theta Gold ordered long-lead processing plant equipment for the TGME project, keeping commissioning on track for end-2026 (TGM)

VBX received assays from 145 infill holes at the Wuudagu C deposit, including 7m at 50.6% Al2O3 and 9m at 44.9% Al2O3 (VBX)

Golden Horse’s RC drilling at Baby Queen & Lake View returned shallow gold intercepts, including 2m at 8.1g/t Au from 64m and 3m at 4.7g/t from 25m (GHM)

Beacon received assays for the first 118 holes at Iguana, including 36m at 6.5 g/t gold from 145m, and will update the MRE and Ore Reserve in Jan 2026 (BCN)

Metallium is in a trading halt pending an announcement on a material collaboration and associated funding arrangements with a US partner (MTM)

Altair’s structural study at South Oko identified 3 D2 deformation targets. Work will proceed with validation mapping & ground geophysics in Jan 2026 (ALR)

Brightstar's Sandstone Hub RC drilling returned broad mineralisation, including 157m at 1.1g/t Au from 18m and 73m at 1.14g/t Au from 11m (BTR)

Stellar released metallurgical testwork on Severn deposit showing potential total tin recoveries of 75% with concentrates grading 45-50% Sn and 72-93% sulphide rejection, supporting the Heemskirk tin project PFS (SRZ)

Sun Silver increased the Maverick Springs resource to 539Moz AgEq at 71g/t AgEq, all in the inferred category (SS1)

Nexus reported aircore drilling at the Wallbrook gold project highlighting shallow intercepts including 4m at 2.47 g/t Au (NXM)

Golden Horse’s RC drilling at Baby Queen and Lake View returned shallow gold intercepts, including 2m at 8.1 g/t Au from 64m (GHM)

European Lithium is in a trading halt pending an announcement about a material offtake arrangement with Critical Metals Corp (EUR)

Rio hosted a Lithium investor site visit in Argentina, sharing a new presentation (RIO)

High Grade It

Australian lithium miners finally have something to smile about after big stock rebounds, with some banks now questioning if they’ve run too far (Australian)

US Secretary of State Marco Rubio said building diversity into critical minerals supply chains is the central way that Australia can work with the US (AFR)

India’s planned energy overhaul will effectively open its atomic power sector to new investment, joining a global nuclear renaissance (Bloomberg)

China’s long-term benchmark power-station coal price for 2026 has been set at the same level as this year, US$95/t (Bloomberg)

Glencore is sacking workers at its Murrin Murrin nickel mine in WA but denies that job losses are the first step in an eventual shutdown (Australian)

Lawyers have pocketed an extraordinary $48m from a major shareholder class action against BHP, over 3x what they originally promised group members (AFR)

Want to expedite field work, get results sooner & move your project forward? Go with SciAps, the leaders in portable analytical instruments with the power to measure any element.

Anglo has withdrawn a resolution on executive incentives, the day before shareholders vote on its takeover of Teck (Bloomberg)

Good Importing International paid $300k to extend its exclusive option to invest $4.8m for a 75% interest in the Taralga and Penrose bauxite projects to 11 June 2026 (ABX)

Matsa said AngloGold Ashanti paid a $1.5m option fee early for the Lake Carey gold project, bringing total receipts under the agreement to $7.2m (MAT)

FIRB has issued a no-objection to Snow Lake’s proposed schemes to acquire 100% of Global Uranium and Enrichment (GUE)

Gold Royalty Corp has agreed to acquire an existing royalty on Pedra Branca (BHP operating Cu-Au mine) from BlackRock World Mining Trust for US$70m in cash (GROY.NY)

Almonty has filed a prospectus in the US to offer 15.0m shares, with an underwriters' option for a further 2.3m, to fund project work and general corporate purposes (AII) pricing TBD but raise size is ~US$100m

EcoGraf submitted the IER to KfW IPEX-Bank as part of DD to secure a senior secured loan facility of up to US$105m, with term sheet target Q1 2026 (EGR)

EQ Resources entered a 3-year €15m prepayment facility repayable by from monthly WO3 concentrate deliveries and a 5-year offtake for 3.5kt WO3 (EQR)

Gold Royalty Corp completed an upsized US$70m placement at US$4/share, (GROY.NY) Funding its above deal

One week until our Xmas Drinks on Tuesday 16 December from 5pm at BrewDog Perth.

Come grab a beer and talk about mining stocks all night. Be sure to RSVP & add to your calendar 👉 https://calendarlink.com/event/9FJi5

Word on the Decline - The Battle for Bankan

Interesting to see the Street Talk article out this morning suggesting Robex is readying to exercise their matching right (point to MoM for scoop a day earlier again)

But we don’t agree with the line of reasoning in the article. The value prop of a RXR-PDI tie-up for Predictive shareholders is super simple to understand: own a larger cut of the pie in a much faster-growing horse (with actual synergies)

Street Talk article this morning

Yesterday we wrote that we thought 45% RXR / 55% PDI would get the job done. Well, we now suspect a proposal tabled along those lines has been rebuffed by Predictive’s advisers

The Citi analysts must have been smoking the Guinean gunja to arrive at 36.5% / 63.5%

We hope common sense prevails and a deal can be done at a fair split. But right now, Perseus is in pole position

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

It's Happening... (YWR) A bullish outlook for US equities. Not the consensus view in our circles, so good to challenge that view

Ferg's Radar (Trader Ferg) Tin, Plats & Rhodium, GSCI Commodity Index, IEA

The 'anti-China' boom driving mining (Dryblower)

Soon All Commodity Charts Will Look Like Gold - Michael Hartnett (ZeroHedge) This is what we all want to hear, right?

The $92B deal that BHP & Rio missed could define copper battle (AFR)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

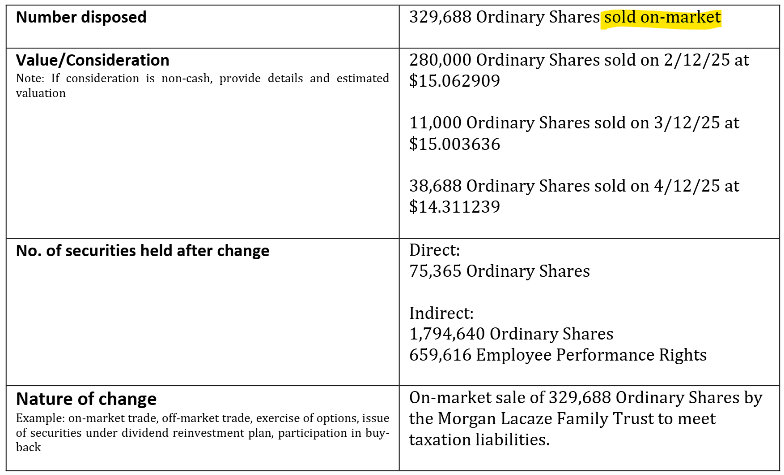

Lynas revealed yesterday that CEO Amanda Lacaze sold ~$5m of shares earlier last week for tax reasons. Guess we’ve gotta cool our jets on any near-term LYC deal speculation.

Our Latest Show