The Pre-Start

Greatland reported West Dome UG drilling with wide, high‑grade intercepts in the Western Stockwork Corridor and Eastern and Western Limbs, added a third diamond rig and targets a maiden MRE in March 2026 (GGP)

Bellevue resumed development at Deacon North with a dedicated jumbo, grade control drilling commenced, and ore production remains on schedule for June 2026 quarter, while Shaun Hackett was appointed Chief Geologist (BGL)

DPM’s feasibility study for Čoka Rakita, using a US$1,900/oz gold price, delivered an NPV5 of US$782m, IRR of 36% & 1.8 year payback, after initial capital of US$448m. AISC to be $644/oz on production of 148koz pa (DPM)

Kingsgate has terminated all discussions between itself, the Thai govt, & the Kingdom without an issuance of an award (KCN) A long chapter now closed

Hot Chili's first diamond twin at La Verde returned 529m at 0.41% Cu and 0.21 g/t Au from 41m to EOH (HCH)

Southern Cross is in a trading halt pending an announcement on the Victorian gov’t decision on its Sunday Creek tunnel (decline) Work Plan (SX2)

Peel completed 20 RC holes at Nombinnie with assays for 9 holes received, including 33m at 2.47g/t Au from 21m (PEX)

Torque’s DHEM on four step-out holes at HHH confirmed mineralisation at depth and identified two new east–west lodes south of the resource (TOR)

Rumble's scoping study for the Western Queen South underground project (58koz at 2.9g/t) revealed an NPV of $112m with <$10m in start up capex (RTR)

Tanami reported final assays from a program at Groundrush and Western Dolerite, returning intercepts including 2m at 20g/t from 130m (TAM)

Neometals reported first gold assays from Barrambie Ranges drilling, returning significant intercepts including 5.0m at 5.64 g/t Au from 84m (NMT)

Athena Resources has declared a maiden resource at Byro South of 47Mt at 29% Fe (AHN)

Atlantic Lithium has withdrawn Resolution 6, to issue an additional 10% placement capacity, after review of proxies (A11)

Aurelia's chair Peter Botten will step down after the 2025 AGM, with Bruce Cox appointed interim chair (AMI)

1832 AM disclosed a 7.4% holding in Golden Horse (GHM)

High Grade It

China’s property market is bracing for a worsening crisis at state-backed China Vanke as the builder fails to convince investors it’ll avoid default (Bloomberg)

BHP’s massive copper expansion in SA was once a certainty, but the megaproject is now shaping up as a test of Australia’s economic future (Australian)

The global silver market faces a fresh risk after Chinese stockpiles sank to the lowest in a decade (Bloomberg)

QLD’s Premier defended giving taxpayer incentives to the $2.3B Eva mine while offering coal projects only ‘certainty’ despite industry job losses (Australian)

NRW Holdings called out inconsistent policies on executive remuneration by proxy advisers as it faces an 8th consecutive pay strike (West)

Boost productivity, shrink your running costs – all with the gear you already own. Switch Technologies makes hybrid simple, affordable and proven. Check it out.

Lithium brine assets in the Americas are now in Liontown’s sights with the company champing at the bit to make an acquisition (West) “There may be a hedge that we have to look at in terms of managing that battery chemistry evolution by possibly focusing on other forms of lithium, like brines.”

Canada will submit the proposed merger of Anglo & Teck to a national security review, Industry Minister Melanie Joly said (Reuters)

Rio Tinto is looking to sell its boron assets in the US (Bloomberg) business supplies 30% of global boron demand, may fetch ~$2B

Boab Metals secured a binding $236m project finance debt facility from Merricks Capital and Davidson Kempner to develop Sorby Hills, targeting FID in Q4 2025 and first drawdown in H2 2026 (BML)

Cabral announced the closing of a US$45m gold loan and drawdown (CBR.V)

Silver Tiger closed a C$40m bought deal financing (SLVR.V)

Word on the Decline

We hear that Iluka quietly told staff this week that Cataby and SR kiln will stay idled for longer than flagged in the current dire market conditions.

Brownfields opportunities at Jacinth Ambrosia, which has been the company’s longtime cash generator (other than the DRR stake), haven’t meaningfully progressed, and only ~2 years of mine life now remain.

The company’s balance sheet continues to look fragile as Balranald’s mineral commissioning kicks off this week and the focus migrates towards the controversial Eneabba rare earths refinery.

Short interest is ~9%, the 13th highest of ASX stocks.

But to be fair, Iluka’s balance sheet is in much, much better shape than its industry peer, Tronox.

Tronox’s net debt to trailing-twelve month Adjusted-EBITDA was 7.5x last quarter.

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Tertiary PE LP buyout funds scale new heights of absurdity (Lyall Taylor) Super insightful. Lyall’s latest post is fascinating if the previous article tickles your fancy

Brazil’s Federal Public Prosecutor's Office (MPF) One of the article behind why VMM & MEI went into trading halts yesterday

Update on my largest copper position: Aldebaran (Paulo Macro)

The copper decade: Why demand is exploding and the 2 stocks set to benefit (Livewire) BHP, Worley

Tether, the gold whale (FT)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

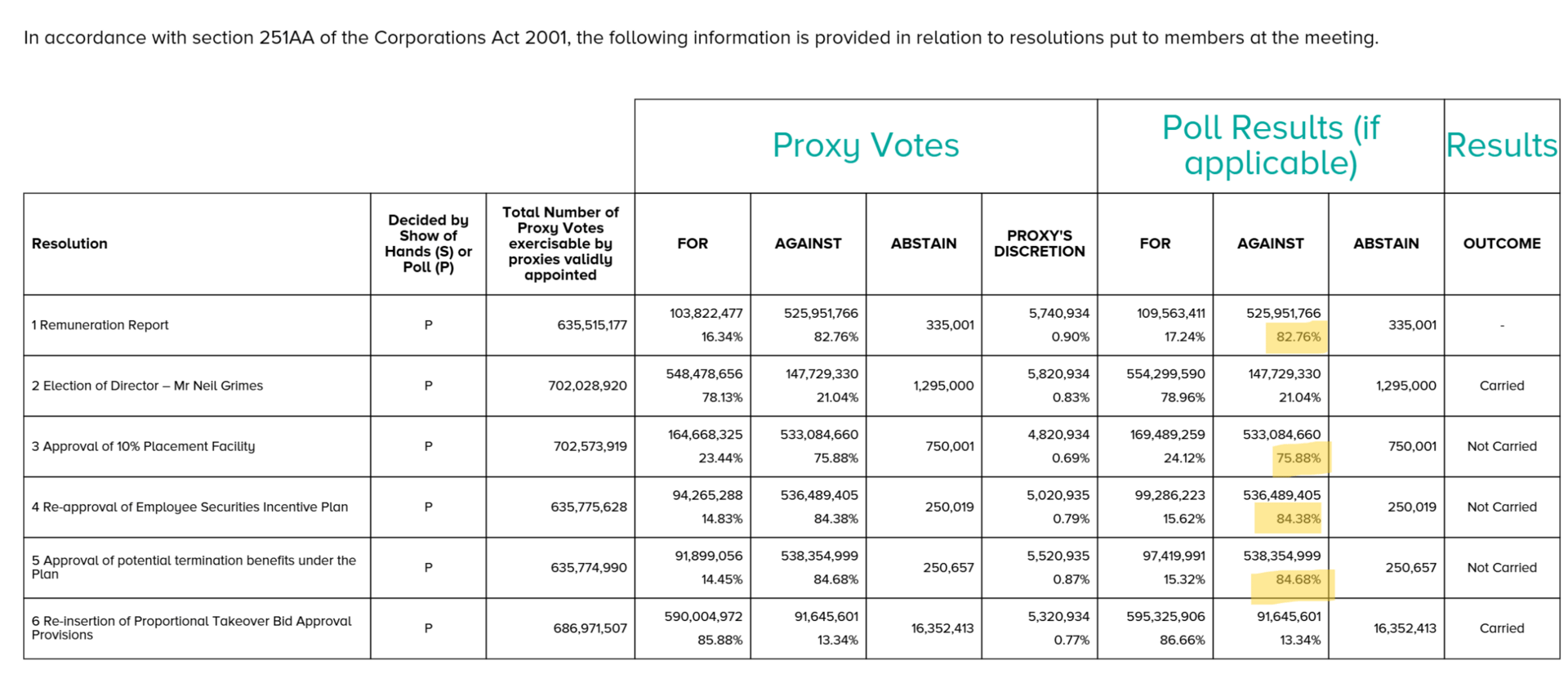

Strong vote of support from the shareholders at Celsius at yesterday afternoon’s AGM

Our Latest Show

Why BHP Will Return for Anglo (Again)

Stocks covered: BHP, ALL.L, RIO, TECK.TO, PLS, IGO, LTR, ELV, ALB.NYSE, SQM.NYSE, 9696.HK, 1772.HK, MIN, DYL, GMD, VAU