The Pre-Start

Vault consolidated its shares 6.5-to-1, with deferred-settlement trading under VAUDA from today until 27 Nov, when the code reverts to VAU (VAU)

Emerald secured full permitting for Memot & received an extension to the Okvau MIA allowing equipment imports for upcoming underground works (EMR)

Resolute announced an initial inferred MRE at La Debo, Côte d'Ivoire, of 17.6Mt at 1.14 g/t for 643koz of gold, a 60% increase over the historic 400koz (RSG)

FireFly’s Green Bay resource has risen 51% to 50Mt M&I + 29Mt Inferred, lifting contained copper to 863kt (M&I) and 566kt (Inferred) and gold to ~1.1Moz (FFM)

Titan reported wide porphyry‑hosted gold‑silver-copper intercepts at Kaliman and Brecha‑Comanche, with four diamond rigs continuing drilling ahead of a Dynasty resource update expected in Q1 2026 (TTM)

Southern Cross Gold reported a Golden Dyke intersection of 9.2 m @ 32.2g/t Au and 1.0% Sb from 604m, including 0.2 m @ 986 g/t Au (SX2)

Meteoric completed wet commissioning of its 25kg/hour pilot plant at Caldeira; process commissioning will begin with first MREC production expected in Dec (MEI)

Santana reported infill drilling at the RAS Northern Honeypot returned hits including 13.5m @ 8.6g/t and 21.1m @ 5.3g/t with visible gold (SMI)

Polymetals recommenced mining and continuous milling at Endeavor, shipped silver-lead and zinc concentrates with a second shipment due in early December, and expanded near-mine drilling (POL)

Beacon declared a fully franked total dividend of 5c per share, with a record date of 10 Dec 2025 and payment date 18 Dec 2025 (BCN)

Ballard reported Baldock infill drilling returned assays including 1.7m at 71g/t from 398m and 3m at 64.2g/t from 277m, with the Phase 1 (80,000m) program 83% complete (BM1)

Astral reported Theia in‑fill RC results from 82 of 99 holes confirming multiple broad gold intercepts, discovering encouraging Theia West mineralisation (AAR)

Aurum hit 3.1m @ 70.8g/t Au from 113m at Boundiali as part of a 100km infill drill program, with major MRE updates and a PFS due Q1 CY26 (AUE)

Lunnon Metals updated the Lady Herial MRE to 559kt at 2g/t Au (36koz), with regulatory approval for an open pit pending (LM8)

McLaren Minerals upgraded their mineral resource for their McLaren titanium project in the Eucla Basin to 529Mt @ 4.5% HM (MML)

European Lithium advised 4.6m options expired unexercised and the underwriter, Evolution Capital, will be issued 4.6m shortfall shares at 8c each, not requiring shareholder approval (EUR)

Dateline's Colosseum infill drilling returned gold intercepts of 85m @ 1.33g/t and 61m @ 1.18g/t (DTR)

High Grade It

Lithium prices and shares in producers of the metal surged after Ganfeng Chairman Li Liangbin predicted 30% demand growth next year (Mining.com) PLS $4+, IGO $7+, LTR $1.50+

China added an estimated 15t of gold to its forex reserves in Sept as central banks accelerated their purchases of bullion (Bloomberg)

Hancock bought an additional 1m shares in MP Materials during the Q3, lifting its stake to 8.4% and making it the firm’s biggest shareholder (Bloomberg)

Gold Fields more than double its 2022 capex estimate for the development of Windfall in Quebec, to ~US$1.3B, maintaining the investment makes sense (NM)

The DRC has extended for 6 months a ban on trading tin, tantalum & tungsten from dozens of artisanal mining sites in conflict-hit Eastern provinces (Reuters)

Rio Tinto will almost halve production at its Yarwun Alumina refinery, cutting 180 jobs, as the company seeks to cut cost (Herald Sun)

Indonesia coal power phase-out plan at risk due to stalled international funding (Reuters)

Trafigura's $600 million nickel fraud trial starts in London (Reuters)

Partner with Blue Cap Mining to fuel your open-cut projects with lean capital, expert fleet and proven mine management, so you can scale fast and safely. Check them out today.

Tether and the Lundin Family have each acquired a 12.7% cornerstone stake in Versamet Royalties by acquiring Royal Gold’s entire stake (VMET.V) Both Tether and Lundins have the right to nominate a director subject to minimum ownership

CATL’s third-largest shareholder, Huang Shilin, will sell 1% of his holdings to institutional investors (Bloomberg) CATL stock down 5.4%

Rattlin’ the Tin

Viridis received a non‑binding LoI from Export Development Canada for up to US$100m to support debt financing for the Colossus (VMM)

Word on the Decline

Wyloo’s first step in rare earths was that 2022 convertible into Hastings, secured by Neo Performance Materials stock. That structure ultimately handed Wyloo 60% of Yangibana plus the Neo position. A month ago they exited Neo near the highs (C$20/sh), which raises an obvious question.

If the original motivation for the Hastings deal was their conviction in Neo, and if that view has changed, why keep the Yangibana exposure in its current form? We wonder if a sale of the 60% Yangibana stake back to Hastings or an alternative way to lock in the unrealised profit from their investment is beyond the realm of possibilities?

The elephant in the room is Iluka. Their future Eneabba refinery has already indicated third-party feedstock sources from Northern Minerals’ Browns Range, Lindian’s Kangankunde and RareX’s Mrima Hill. When Yangibana?

One thing we’re watching for as well: Newmont’s 1yr lock-in over its Greatland stake expires in two weeks. Wyloo’s very in-the-money call option covers half of Newmont’s shares.

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

The House Select Committee on the CCP Predatory Pricing - “How the CCP manipulates the critical minerals markets to further its global authoritarian ambitions" in 12 Findings

This Time It’s the Same (Myrmikan Research) Fixing yesterday’s broken link!

YWR: China Trip Highlights (Erik) Must read for those thinking about China. BYD, Tencent & UBTech Robotics site visits with videos

Lithium stocks are overheating (Dryblower)

A new rare earth crisis is brewing as yttrium shortages spread (Reuters)

Europe needs to act now on its metals vulnerability (FT)

The gold rally most investors missed... (Livewire) On the continuing disconnect between bullion & equities

Were you forwarded this email from someone else?

Today’s Top Tweet

They nuked his Twitter account. But Dwayne will be back. Keep reading our emails this week for more…

Devil’s in the Detail

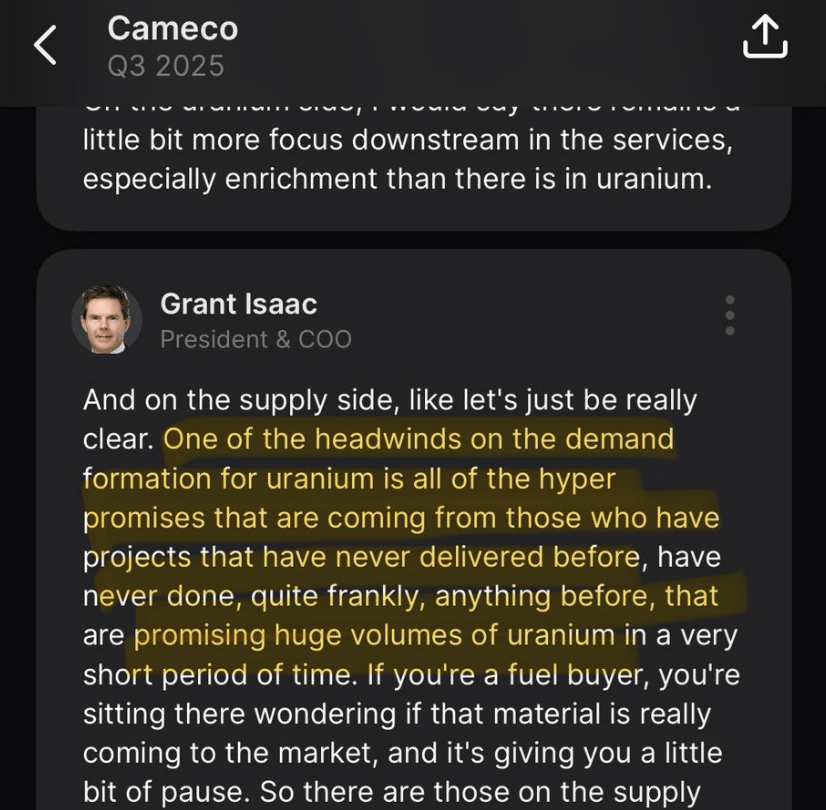

No idea who Grant could be talking about here.

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube

The New Commodity Supercycle Is Already Here (Paulo Macro)

Stocks covered: SFR, FCX.NY, HBM.TO, IVN.TO, FM.TO, CSC, TGB.NY, ALDE.C, CCJ.NY, URA.NY, UEC.NY, NXG, U.U, YCA.L, VAL.NY, SDRL.NY

New episode out 5pm today