The Pre-Start

Rio Tinto’s 2025 annual report shows US$58B revenue, $25.4B underlying EBITDA, profit after tax $10B, net cash from operations $16.8B and plans to release $5-10B of cash. It announced a final dividend of US$2.54 per share (RIO)

Newmont reported FY25 results with US$7.3B free cash flow, declared a US$0.26 Q4 dividend and provided 2026 guidance of ~5.3Moz attributable and US$1,680 by-product AISC (NEM) Strong Q4 performance

Ivanhoe reported 2025 profit of US$228m on adj. EBITDA of US$578m. KK’s cost of sales were US$2.82/lb with C1 costs of US$2.16/lb, falling within its revised guidance. It expects copper anode shipments along the Lobito railway imminently, and an MRE for Makoko by mid-year (IVN.TO)

Ramelius reported record H1 underlying EBITDA of $348m, underlying NPAT $160m, declared a fully franked 3cps interim dividend, and replaced its $175m facility with a $500m undrawn revolving facility (RMS)

Perseus reported US$186m profit for H1 on revenue of $608m, plus a 100% higher interim dividend of 5cps. It confirmed FY26 guidance of 400–440koz & lifted the Nyanzaga reserve to 4Moz (91Mt at 1.38g/t), a 73% rise (PRU)

Paladin is in a trading halt pending an announcement about an approval for the PLS project (PDN)

GR Engineering reported HY26 revenue $218m, EBITDA $28m and PBT $25m, and declared a 12cps dividend (GNG)

Asara's drilling at Kada returned 54 m at 2.3 g/t Au from 42m, confirming NE structural continuity and informing Phase 1 conversion drilling (AS1)

The Swedish Energy Agency declined Talga’s $180m IK2 grant, but the $31m FEED study for a 5ktpa anode plant remains funded (TLG)

High Grade It

Rio said the cost of mining Australian iron ore could rise by a further 6% in the year ahead, highlighting key productivity challenges (AFR)

Teck reported a jump in earnings aided by higher copper prices, while reaffirming output guidance, including at Quebrada Blanca (Bloomberg)

Ivanhoe plans to open offices in NY & DC to understand the US govt’s viewpoint, with the US placing the DRC at the "highest order of priority internationally" (Bloomberg)

Lithium Americas said capex for Phase 1 of its Thacker Pass lithium project will range between $1.3B and $1.6B in 2026 (Reuters)

The MinRes turnaround is in full swing as Onslow performs and profitability returning (AFR)

The new Wesfarmers lithium hydroxide refinery on the outskirts of Perth played down its odour problem (Australian)

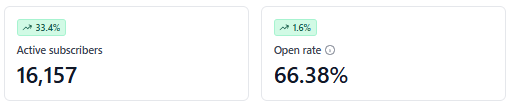

You’re reading this.

So are over 16,000 other very influential people in the mining sector.

Reach them where they are paying attention 👇

South African-headquartered Gold Fields is closely watching WA’s gold sector consolidation, with $2.5B in the bank (BN)

Glencore is in talks to sell its stake in Kazzinc to local businessman Shakhmurat Mutalip as part of a series of deals that could reshape Kazakhstan’s mining landscape. Rumoured US$4-4.5B deal (Bloomberg) Mutalip also rumoured to be buying 40% of Kazakh miner ERG

Vale agreed to sell an 81% stake in the Thompson Nickel Belt op’s to a consortium of Exiro Minerals, Orion and Canada Growth Fund (Bloomberg)

Coal giant Whitehaven eyes new acquisitions after rivals falter on major deals, 2 years after its deal to buy Daunia & Blackwater (Australian) Anglo’s mines listed plus EMR’s Kestrel

Atlantic Lithium is in halt as it responds to a price query and to address speculation over its mining lease and a corporate transaction (A11)

Thesis Gold announced a C$44m strategic investment by AngloGold Ashanti and participation by Centerra Gold (TAU.V)

Gold Royalty lifted its US$150m facility with BMO, National Bank and RBC at SOFR plus 2.25-3.25%, and flagged broad operator progress that strengthens medium-term royalty cash flow (GROY)

Word on the Decline

MinRes’ results today hint at something we had heard a few months ago: that the company has been doing a fair bit of work on scoping out a fourth train at Wodgina

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Glencore’s gone. And Rio doesn’t have a growth rabbit under its hat (AFR’s Chanticleer)

Why Gold and Silver May Be the Last Defense Against Inflation and Debt (Goehring & Rozencwajg)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

Buried in the Newmont Annual Report this morning: they have hit Barrick with a Notice of Default under the Nevada Gold Mines JV Agreement!

Our Latest Show