The Pre-Start

MinRes NED Denis McComish resigned effective 23 April (MIN) The appointment of a new Chair expected to be announced this quarter

Newmont generated US$2B in operational cash flow & US$1.2B in free cash, from production of 1.5Moz. It received US$2.5B in cash from divestments (NEM)

Liontown generated $14m of operational cash flow, while cash closed down 10%. AISC was US$678/t (SC6e) while it realised a US$815/t on 96kt of production (LTR)

First Quantum reported US$143m in operating cash flow while investing US$258m. It produced 100kt of copper while net debt lifted to US$5.8b (FM.TO)

Resolute produced 75koz at an AISC of US$1,708/oz, while spending US$25m in capex. Net cash lifted $34m on $75m in operational cash flow (RSG)

Emerald released an exploration & resource drilling update across its portfolio, with Memot’s strike interpreted at 1,100m, 900m wide to a depth of 450m (EMR)

Southern Cross’ latest drilling at Apollo saw it hit 100.5m @ 3.1g/t from 821m, with the company observing grade improvement at depth (SX2)

Hillgrove mobilised mining contractors to accelerate Nugent, with first ore targeted for the Dec quarter (HGO)

Kinsgate reported a successful trial of new blast movement tech, which will now be incorporated (KCN)

Chalice closed March with $83m in cash, with its PFS to be completed by Q3 (CHN)

Caravel provided an update on a simplified process flowsheet for its Caravel copper project, while closing with $6m in cash (CVV)

Sumitomo emerged as a 5.1% holder of Ardea post its recent strategic placement (ARL)

Newly ASX-listed Marimaca shared a corporate presentation

High Grade It

Trump’s administration signalled openness to de-escalating its China trade war, while considering slashing tariffs by ‘more than half’ (AFR)

The Albanese gov’t will effectively help underwrite the development of critical minerals projects through the establishment of a strategic reserve, with $1.2b earmarked (Reuters)

Newmont posted its highest quarterly costs in at least nine years, with AISC hitting US$1,651/oz, though profit topped estimates (Bloomberg)

The last remaining member of MinRes’ ethics committee has quit the miners’ board just a week after the exit of two other directors (AFR)

Panama’s President said his gov’t is studying options to restart the nation’s flagship copper mine without the need for congressional approval (Bloomberg)

Who are the frontrunners to replace BHP’s Mike Henry? (West) Internal frontrunners named: Geraldine Slattery, Vandita Pant, Ragnar Udd

Bets are off that BHP will return for Anglo amid Mike Henry’s exit (Australian)

Copper gained 2%, pushing higher with other metals, as the US signalled a more conciliatory tone toward China (Bloomberg)

Lindian has asked police to drop the charges against two Chinese nationals who were trespassed, stating ‘we don’t want to fight China’ (Australian)

Receivers have taken charge of privately-run Northern Iron just one week after the miner appointed voluntary administrators (MNN)

Clive Palmer is willing to clear the way for CITIC to continue operating after suffering a Supreme Court setback, with his royalty claim rejected (Australian)

Spot gold slipped 3% to $3,310/oz as tariff worries eased (Reuters)

Improve your orebody knowledge with the legends at Datarock! Request a demo of their platform here

Wheelin’ n Dealin’

Capricorn agreed to acquire the Ninghan gold project off Sabre, covering 77km2, located contiguous to of Mt Gibson. It’ll pay upfront $1.6m, mostly in stock, plus a 1% NSR royalty & a further $1.75m in deferred payments (CMM)

Sierra Metals agreed on a deal whereby Alpayana will pay C$1.15/share, a 3% lift of its rejected hostile bid. The all-cash bid values Sierra at ~C$240m (NM)

Impact Minerals will acquire 50% of the newly formed Alluminous, which acquired 100% of HiPurA (administrators appointed) which owns the HiPurA HPA processing technology previously developed & owned by ChemX (administrators appointed) (IPT)

Rattlin’ the Tin

Victory Metals received a LoI from the US EXIM for up to US$190m in project financing for the development of its North Stanmore project in WA (VTM) ahh yes, one of those “non-binding letters of interest”…

Word on the Decline

We couldn’t help but notice a familiar name in the sell-down of Serabi Gold shares. Following the sale of 19.9% to Brazillian PE group Starboard earlier in the month, Greenstone Resources II LP trimmed its remaining 5.2% holding overnight

Reading “Greenstone” piqued our interest because we used to read the PE group’s name everywhere. Now it’s been years since we've seen their name. We weren’t even sure of the status of the funds…

With 20 seconds of research, we found this SEC filing from last month suggesting Greenstone’s Fund II had a gross asset value of US$148m and Fund I US$42m. The Serabi stake will crystalise ~US$36m of that

And if those SEC filing numbers are accurate, there’s more value left for LPs than we hastily would have assumed…

When the dust settles, we think Greenstone’s story will make for an excellent case study in business school: Why private equity does not work in mining.

Do you have some Word on the Decline? Reply to this email or shoot a message to [email protected] directly. We will always take your privacy seriously.

In the Weeds

Modern-Day Asset Management Business w/ Anthony Deden (YouTube) A long-form interview from a few years back, well worth its time

Were you forwarded this email from someone else?

Today’s Top Tweet

Here for the cheap MinRes gags? You can count on us. And Twitter.

Devil’s in the Detail

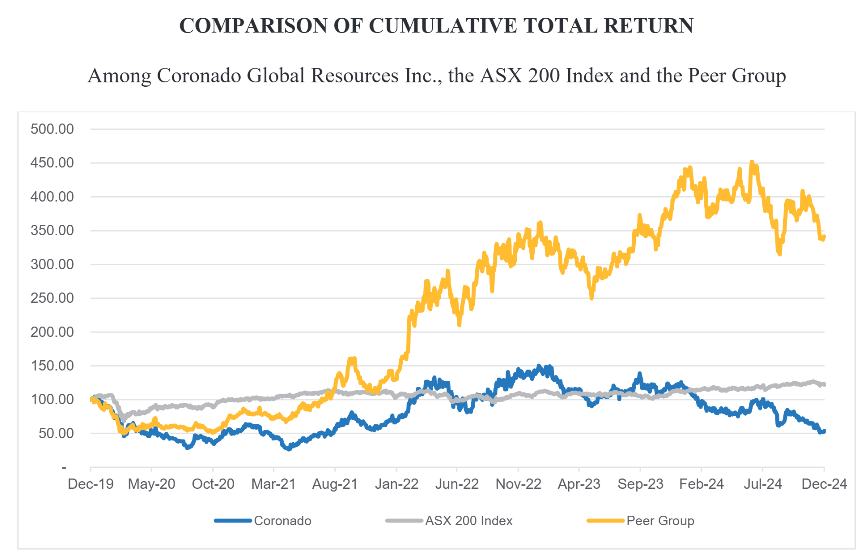

If you got a bit lost reading through Coronado’s 253-page Notice of Meeting ahead of its AGM, don’t worry, we plucked out the only thing shareholders actually care about. It was on page 241:

While scrolling through the nonsense, if you happen to stumble upon the peer group used for exec rem benchmarking, you’re very, very lost. Abort immediately.

We don’t need to point out the obvious, do we?

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube