The Pre-Start

Predictive Discovery & Robex are merging in an all-share deal (PDI) Details below

Capricorn produced a record 32koz over the quarter, with cash and gold up $38m, after spending $34m, mostly on the Karlawinda Expansion Project (CMM) While its latest R&R statement outlined a 684koz at 3.1g/t underground resource at Mt Gibson, and Karlawinda ore reserve estimate of 1.3Moz at 0.8g/t (CMM) MGGP underground scoping study imminent

Emerald anticipates Sept quarter production to be 22koz, below guidance due to heavy rainfall restricting access, with AISC forecasted to be ~$US1,150/oz (EMR)

European Lithium is up 75% this morning on the back of the news that the Trump administration is eyeing a stake in the Tanbreez rare earths deposit in Greenland. EUR has a 60% stake in CRML and 7.5% direct interest in Tanbreez

Aurum updated the mineral resource at Boundiali, which now sits at 2.4Moz at 1g/t, using a 0.4g/t cut-off above 300m (AUE)

Sheffield’s total ore mined at Thunderbird lifted 6% in the latest quarter, with record concentrate production of 249kt (203kt being ilmenite) (SFX)

Encounter released new assays from Green, where it hit 85m at 3.1% Nb2O5 from 48m (ENR)

Leeuin Metals hit 9m @ 5.23g/t gold from 57m at their Evanston project (LM1)

Carnaby hit 6m at 7.1% CuEq from 331m in its latest round of drill results from the Trek 1 prospect (CNB)

Great Boulder shared assays from 21 RC holes at Side Well South, hitting 21m at 2.22g/t from 41m (GBR)

Tungsten Mining released a gold resource at its Mt Mulgine project, totalling 1.9Mt at 1.1g/t for 67koz (TGN)

Peter Botten will step down as Chair of Aurelia, while Rachel Brown has joined as a nominee of Brazil Farming (AMI)

High Grade It

Anthony Albanese will offer Trump priority access to Australia’s critical minerals when they meet this month, to minimise China reliance (West)

Gold’s historic bull run has added billions of dollars to the market value of Australia’s gold miners, with Westgold outshing the pack last week (AFR)

Madeleine King has pledged to strengthen Australia's alliance with Japan amid concerns about US reliability and China's growing regional influence (Australian)

Mali’s military has blocked about 70 fuel trucks bound for Allied Gold’s Sadiola mine after militants imposed a fuel import ban on the nation (Reuters)

Tin has broken higher, topping US$37.5k/t as Indonesia cracks down on illegal miners (Reuters)

The silver squeeze is nearing an end game, according to TD analysts, as prices reached 2011 levels (Mining.com)

Germany will push for a more protectionist stance on Europe's steel industry, urging the EU to adopt a "buy European" strategy (Reuters)

Don’t leave emergency response to chance. Have ARG come to your site and prepare your team, today. Learn about their on-site programs here.

Predictive and Robex are combining in an all share deal, in which Robex holders will receive ~8.7 PDI shares for each RXR share. Following the deal, PDI will hold 51% of the combined company, with an market cap of ~$2.4B. It has outlined amibtions to produced 400kozpa+ by 2029, predominantly from Guinea (PDI) Perseus, your move… (but really, Zijin/Lundin/Montage, your move)

Anglo American launched arbitration proceedings against Peabody after the US coal producer pulled out of a $3.8B deal (Mining.com)

GBM has sold its White Dam gold-copper project in South Australia to Pacgold for up to $4.75m (GBZ)

Rattlin’ the Tin

Word on the Decline

Wondering why NexGen’s raise in Australia got upsized from $400m to $600m? (excluding the C$400m raised in North America separately)

Word on the Decline is that Gina Rinehart’s Hancock Prospecting filled the Australian book with a ~$200-300m order

Keep in mind NexGen’s final permitting outcome is expected in February next year. If the company gets over the line on the permitting, that’s when a transaction makes most sense to us

And Hancock is forcing a seat at the table for an eventual deal. Gina has a history of bidding in consortium. POSCO+Hancock for Senex. SQM+Hancock for Azure. [Aramco/Saudi]+Hancock for NexGen?

The breadcrumbs are there if you look hard enough..

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

China trade tensions show Australia’s choices getting harder (AFR op-ed)

Marathon CIO Rob Mullin reveals why gold stocks are still undervalued (Australian)

Record high gold prices add millions to shareholdings of company bosses, board members (West)

Millennium Hires in Dubai for New Pod Focused on Commodities (Bloomberg)

WA broking independent Argonaut wins bragging rights over rival Euroz Hartleys after profit jump (West)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

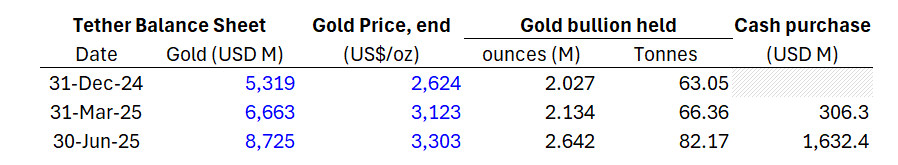

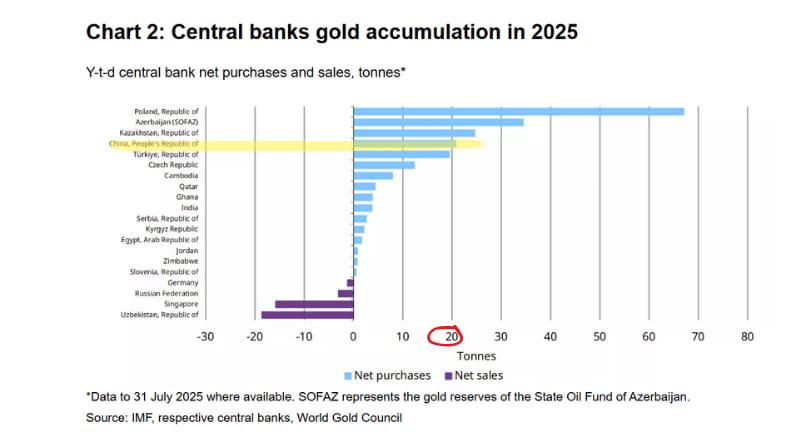

Tether added 19 tonnes of gold to its balance sheet in H1 2025 - 15 tonnes in Q2 alone.

That’s about what China’s central bank bought over the same period. Wait for Q3 figures...

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube

Gold Soars & China Corners BHP (Jeff Quartermaine)

Stocks mentioned: PRU, NEM, B.NYSE, BHP, AAI, FCX.NYSE, WIA, 1208.HK, 2899.HK, NXG, HGO, TSO, STN, JBY, NGEX.TO, PEX