The Pre-Start

Ramelius’ 5-year growth plan outlined ambitions to grow output to 500kozpa+ by FY30. AISC’s to stay <$1,855/oz over the next 3 years, before lifting to $2,250/oz in FY29, when Rebecca-Roe comes online. Dalgaranga will contribute 45% of the ounces from Mt Magnet over the 5-year period. FY26 will see capital spending of ~$400m (RMS) Down 5%. See Rebecca-Roe DFS (RMS) Never Never PFS (RMS)

Liontown produced 87kt of spod concentrate (up 1%) at a 5% grade (down from 5.2%), realising a price of US$700/t (SC6e). Unit operating costs were up 22% while AISC was up 10% to US$886/t sold. Cash closed at $420m following the capital raising (LTR) Down 11%

Bellevue extended the mining contract with Develop for a further 7-months to July 31, 2026 (BGL)

Westgold produced 84koz at $2,861/oz, with cash, bullion & investments lifting $108m to $472m. No guidance changes (WGX) Down 7%

Resolute produced 60koz at US$2,205/oz AISC, spending ~US$27m on capex. Operational cash flow was US$68m, while net cash rose US$26m to US$137m. Syama guidance was revised down, while Mako was lifted (RSG) Down 9%

Develop said it’d hit nameplate at Woodlawn in the March quarter, with 130kt of development & stope ore mined this quarter, up 22%. Cash closed at $204m, while it continues to weigh opportunities (DVP) Down 12%. Grades & output lower than expected

Nickel Industries reported 31kt of Ni production from RKEF, 2kt from HPAL and ore sales of 3Mwmt from mining. RKEF reported EBITDA of US$40m, HPAL contributed US$13m & mining added US$33m, for a total adjusted EBITDA of US$80m (NIC)

Sovereign stated that the prohibition of the export of raw materials does not apply to it or Kasiya (SVM)

Aeris shared a maiden open-pit ore reserve for Constellation of 2.3Mt at 2% Cu, 0.6g/t Au & 3g/t Ag, containing 47kt Cu, 49koz Au and 228koz Ag (AIS)

Black Canyon shared new manganese and iron results from Wandanya, hitting 9m at 30.3% Mn from surface (BCA)

Resolution Minerals hit 189m at 1.3g/t gold from 34m, ending the hole in mineralisation (RML)

New Murchison Gold collected a ~$16m cash payment subsequent to the quarter end for the first month of gold-in-ore sales with Westgold (NMG)

Sheffield agreed a zircon concentrate offtake agreement with Yansteel, in light of deteriorating market conditions, who’ll buy all unsold con at a fixed price, equivalent to the current Chinese market price (SFX)

GoldArc signed a Letter of Intent with MMS, to explore a 50/50 pathway to production at Leonora South (GA8)

Brett Smith has bought ~$60k worth of Mt Gibson stock at 35c per share (MGX)

High Grade It

Copper advanced toward an all-time high with the US and China on the cusp of a deal to dial down tensions, easing a major risk to global growth (Bloomberg)

Surging commodity prices have helped bolster the profit outlook for the ASX by more than $4B, helping to halt 3 years of shrinking earnings (AFR)

Milei’s win cements US partnership in Argentina’s mining (Mining.com)

Gold steadied after plunging below $4,000/oz, as trade talks weighed on demand (Bloomberg)

NextEra Energy & Google have agreed to restart an Iowa nuclear power plant shut 5 years ago (Reuters)

Ramaco plans to establish a strategic stockpile of rare earths at its Brook mine in Wyoming (Mining.com)

Albemarle will generate proceeds of US$660m from the sale of catalyst business interests: (1) selling a controlling stake in Ketjen Corp.’s refining catalyst solutions to PE firm KPS Capital Partners LP; and (2) selling its 50% interest in the Eurecat JV to Axens SA (Bloomberg)

According to Dataroom, Brazilian Rare Earths increasingly looks like a sitting duck for a takeover after its scoping study is completed in H1 2026, with a bid to come from the US (Australian) Article names MP and Lynas as suitors…

Rattlin’ the Tin

Coronado will replace the current asset-based loan with Oaktree with a new agreement with Stanwell, in the shape of a US$265m, 5-year facility with a rate of 9-12%, offering covenant flexibility (CRN)

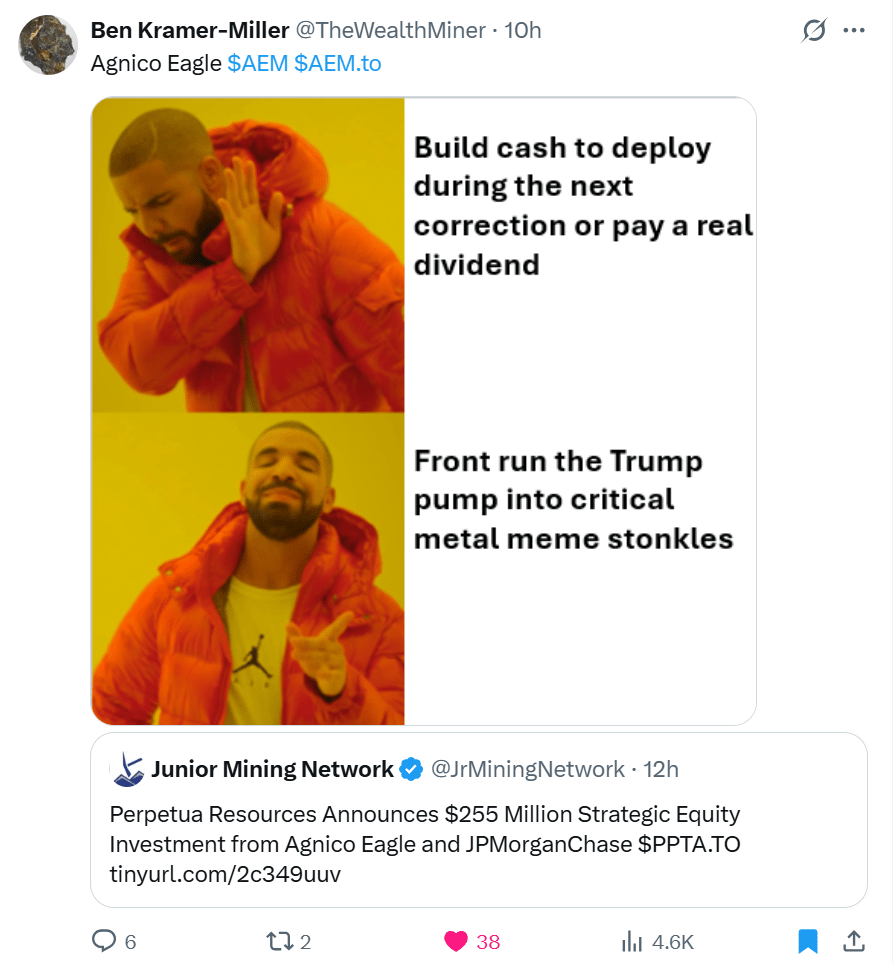

Perpetua Resources has raised US$225m in strategic equity, US$180m from Agnico Eagle and JPMorgan’s Security Initiative is contributing US$75m (PPTA) funds to contribute to development of Stibnite Gold project in Idaho. Agnico to own 6.5% of the pro forma

Arafura is in halt to raise capital (ARU)

Encounter is in a trading halt to raise $20m at 45c (ENR)

Word on the Decline

If it seems like we are fixated on Wiluna lately, fair critique. We’re interested.

And from our interest we learned something that was not obvious to us before. We’ve written here before that Creasy is rumoured to have penned a proposal or two to acquire Wiluna out of administration. In fact we first heard this before he acquired Warawoona out of administration.

But until recently, we didn’t properly understand his longstanding interest in Wiluna specifically. We didn’t know that Creasy owns the Bogada Bore gold deposit ~50km from Wiluna’s Matilda plant (we actually didn’t even know the deposit existed!)

There is a lack of public information about the Bodoga Bore deposit, but an academic paper suggests it’s 1.3Moz at 2.3g/t - extremely worthy of being mined today…

We think a standalone gold plant could be financed with that sort of deposit, but rumour has it Creasy always thought he would be able to buy Wiluna eventually

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

Australia/US critical metals deal doomed to fail, eventually (Dryblower)

State Government should be out promoting the global potential of WA’s uranium sector (West op-ed)

Rare Earths Producers Look to US-Led Boom to Blunt China’s Power (Bloomberg) Trade deal or not, we need diversified supply

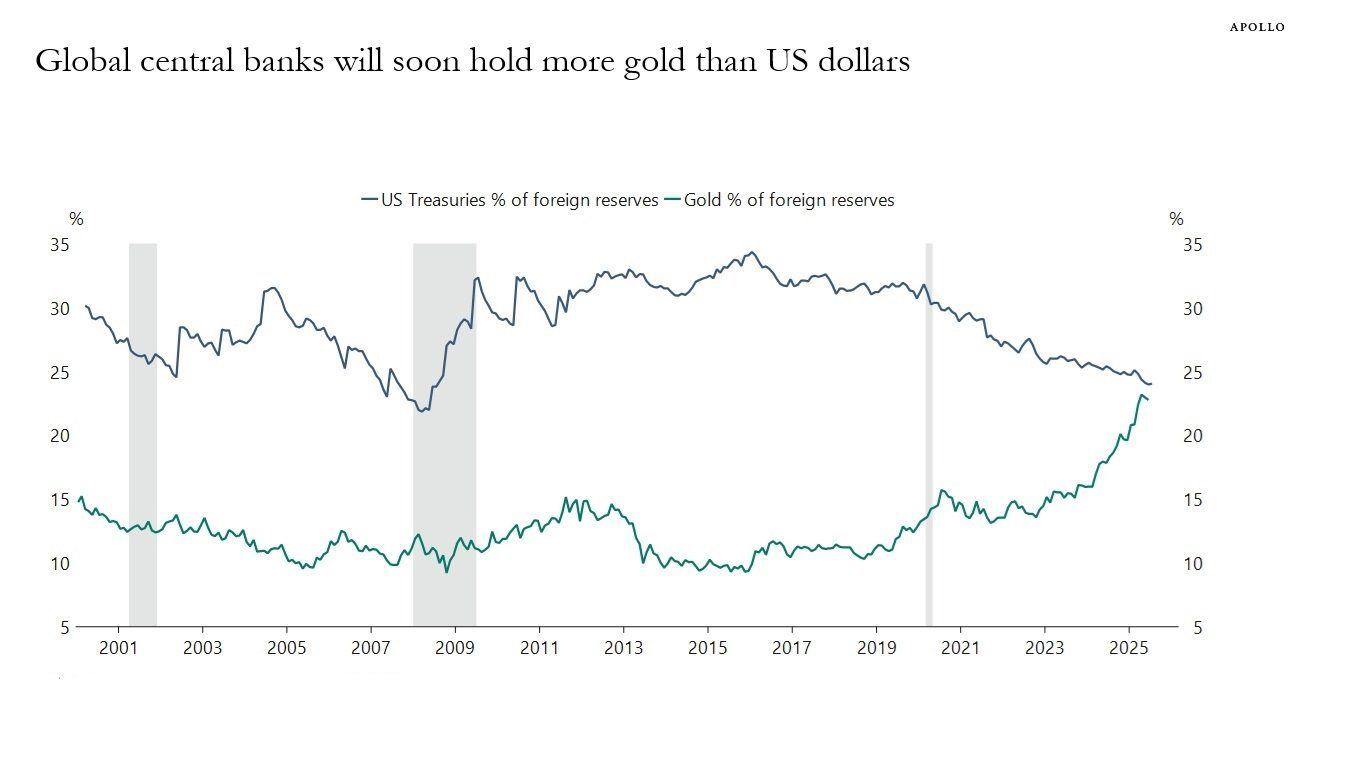

Why are gold prices going up? China is playing a key role according to Apollo’s Chief Economist Torsten Sløk (Apollo) some great charts in this, including:

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

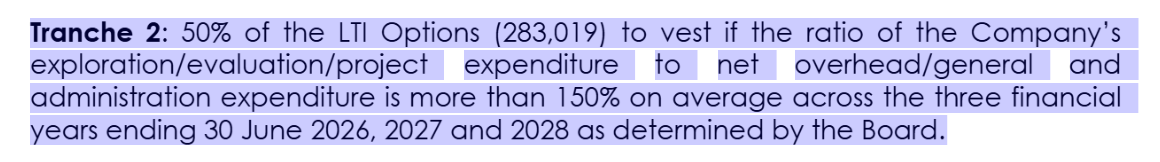

Anyone want a masterclass in KPI design? How’s this from Barton Gold…

Source: BGD Notice of Meeting yesterday

50% of the long-term incentives unlock if, on average, they manage to spend at least 1.5 times more on drilling and studies than they do on head office costs.

That’s it. That’s the hurdle.

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube