The Pre-Start

Rio Tinto will simplify to three product groups, targeting $650m annualised productivity benefits, exploring $5-10B opportunistic asset releases and upgrading 2025 copper guidance to 860-875 kt while cutting mid-term capex to under $10B (RIO)

Northern Star released an exploration update which confirms its FY26 spend of $225m, with 73% dedicated to in mine growth initiatives and the remaining 23% directed towards regional exploration (NSR)

Emerald has received Mining Proposal and Mine Closure Plan approval from the Department of Mines, Petroleum and Exploration for the Dingo Range Gold Project (EMR)

West Wits opened the Qala Shallows mine, South Africa's first new underground gold mine in 15 years, with first gold due March (WWI)

Zeta Resources increased its holding in Siren Gold 9.82% following on-market purchases (SNG)

Syrah appointed Samantha Hogg as an independent NED and incoming chair, effective immediately, succeeding Jim Askew who retires 31 Dec (SYR)

High Grade It

Rio’s new boss has unveiled the major’s most drastic overhaul in over a decade, promising ‘industry-leading returns’ through sweeping cost cuts (Australian)

China said it is working on streamlining rare earth export licenses - a key promised outcome after Trump & Xi met (Reuters)

Goldman’s said the surge in copper past $11k/t will prove short-lived as there's still more than enough metal to meet global demand (Bloomberg)

Covalent (SQM & Wesfarmers) has admitted responsibility for ‘toxic’ smells plaguing Perth suburbs from its Kwinana refinery (Australian)

EU has launched €3B ($5.3B) strategy to reduce its reliance on Chinese rare earths through securing its own supply chain (Guardian)

Mercuria has ordered about $500m of copper for withdrawal from LME warehouses, positioning itself for a global supply crunch (Bloomberg)

Want to drive down your costs & improve efficiencies? Got an engineering problem you don’t have the time to solve? Switch has you covered. Click here to start saving.

Mithril has executed its purchase option agreement to acquire 100% of the La Dura Gold-Silver property adjacent to its flagship asset. The vendor will receive US$4m over 4 years while retaining a 2.5% NSR on production (MTH)

Privately held FG Gold has closed a US$330m senior debt financing package with Africa Finance Corporation and Afreximbank as it begins construction of its ~150kozpa Baomahun gold project in Sierra Leone (FG Gold)

Marex said in talks to buy Levmet in commodities expansion (Bloomberg)

Minaurum announced a C$20m at CAD 36c per share (MGG.TO)

AusQuest completed a $10m placement at 4.7c (AQD)

Larvotto completed a US$32m first drawdown from its US$105m senior secured bond to fund Hillgrove construction (LRV)

Word on the Decline

If we are to read into patterns from the past week…

Kevin Maloney stepped off Pantoro’s board and then Tulla blocked out half its PNR stake the next week

Robert Millner stepped off Aeris board this week. Will a line of WHSP’s 26% stake in AIS become available shortly too..?

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

London Calling (Nov 2025) (Kopernik) Fantastic weekend reading for the value investing inclined

The Changing Faces of the ASX Gold Sector (MFL)

Gold is fuelling Putin’s war machine and keeping Russia afloat (AFR)

Why governments are 'addicted' to debt - an FT vid (YouTube)

Escondida: The $47B Question Nobody Else Is Modelling (AlfaRev)

In situ gold monetisation (Rod Holden)

A New Copper Position (Paulo Macro) Surge Copper

Rio waves a $15b carrot in front of investors (AFR) Selling down stakes infrastructure & potentially mining assets

Australia relying on luck over strategy says Jake Klein (Mining.com)

Were you forwarded this email from someone else?

Today’s Top Tweet

Bullish. Just not bullish enough.

Devil’s in the Detail

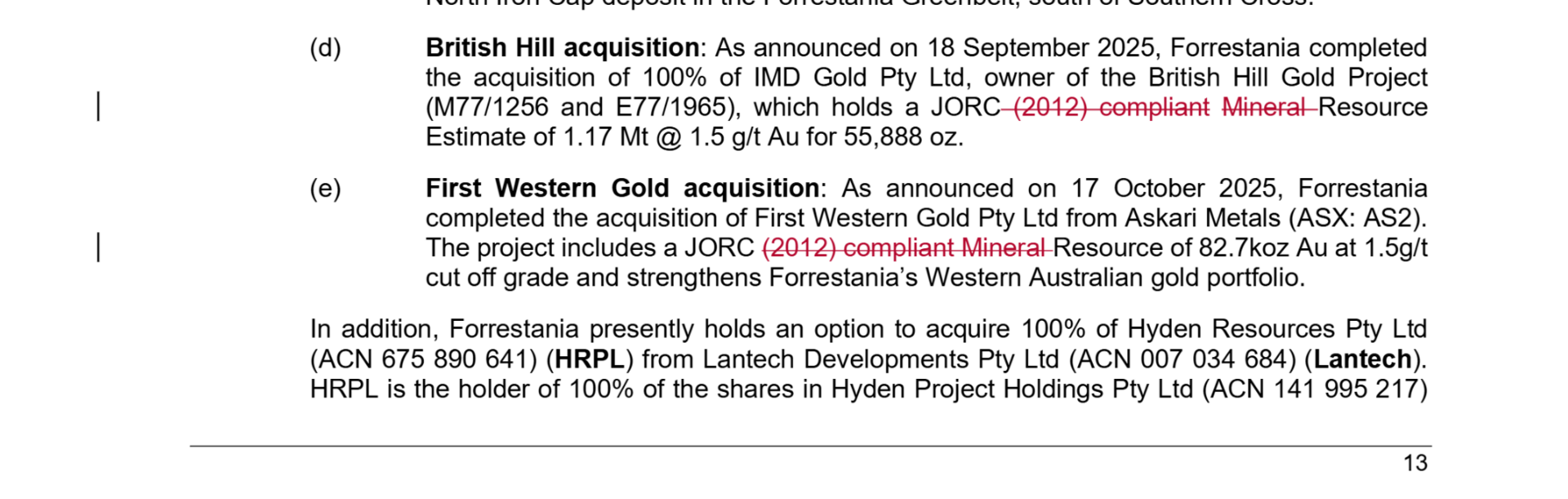

It looks like the JORC police are responsible for Forrestania issuing a replacement bidder’s statement for their takeover of Kula Gold today:

Bidder’s Statement in markup