The Pre-Start

Anglo’s Q4 production came in above expectations as it produced 170kt of copper (down 8% QoQ) and 15.1Mt of iron ore. It’s new copper guidance for 2026 (700-760kt; down ~60kt) matched the market’s expectations. It warned of a further De Beers write-down (AAL.L)

Valterra reported total PGM production of 880koz (up 1% QoQ), with guidance for 2026 to be between 3-3.4Moz. Overall, 2025 production was down 10% (VAL.J)

DPM’s updated estimate extends Chelopech mine life to 2036 with reserves of 23Mt containing 1.6Moz gold and 308Mlb copper, supporting ~160k GEO pa (DPM)

Berkeley's subsidiary filed a Memorial of Claim at ICSID seeking $1.25B compensation over actions affecting the Salamanca uranium project, with Spain given until July 2026 to respond (BKY)

Northern Minerals has commenced court proceedings seeking orders to hold the requisitioned EGM on the same day as the 2025 AGM, while deferring the AGM deadline while the Foreign Investment Division considers matters (NTU)

Flagship completed a study at Pantanillo, identifying an extensive >40km2 alteration footprint with multiple 4–5km by up to 2km zones, new targets and inferred deeper targets (FLG)

Genmin extended non‑binding offtake MoUs with China Minmetals, Jianlong and Hunan‑Valin for Baniaka iron ore project products, renewing each agreement for 18 months (GEN)

Aguia said recoveries at Santa Barbara rose from 70% in Dec to 85%+ in Jan (AGR)

Tembo Capital increased its True North Copper holding to 25% (TNC)

High Grade It

China said it opposes any country undermining the international economic and trade order through rules imposed by small groups, after the US unveiled plans for a preferential trade bloc of allies for critical minerals (Reuters)

Iron ore at risk if Canberra ‘weaponises’ supply against China (AFR) Ideas discussed in this evening’s podcast

Silver fell over 20% as the metal struggled to find a floor following a historic market rout. After volatility, gold traded near US$4,750/oz (Bloomberg)

Australia’s mining lobby slammed the Productivity Commission’s proposed cashflow tax as investment-killing policy (Australian)

Canada said it’d scrap a national EV sales mandate, while boosting incentives (Reuters)

The European Commission is being sued by campaigners over environmental and safety concerns at a project awarded strategic status in Portugal (FT) Could there be a headline that typifies the West any better?

Private energy developer Mass Group plans to invest US$1.2B in battery storage capacity across Romania (Reuters)

Rio Tinto announced is no longer considering a deal with Glencore as it couldn’t reach an agreement on value (RIO, GLEN, Bloomberg) Bloomberg report GLEN wanted 40% of the pro forma

❝The key terms of the potential offer were Rio Tinto retaining both the Chairman and CEO roles and delivering a proforma ownership of the combined company which, in our view, significantly undervalued Glencore’s underlying relative value contribution to the combined group, even before consideration of a suitable acquisition control premium.

Glencore ReleaseMGX completed its acquisition of a 50% interest in Central Tanami from Northern Star, paying $50m and replacing ~$6m of bank guarantees (NST)

Cornish Metals received funding interest from the US government’s export-credit agency for US$225m (Bloomberg)

Global Lithium completed the spin-out of MB Gold listing after a $9m IPO (GL1)

Kingfisher is raising C$20m via bought deal to fund exploration (KFR.V)

NOVAGOLD closed an upsized US$310m bought deal at US$10 to fund Donlin activities, prepay the Barrick note option (NG.TO)

ATHA Energy closed C$63m in financings via US$25m Queens Road Capital convertible debentures plus C$28.8m share offering (SASK.V)

Meridian upsized its bought deal to C$50m at C$1.58 to fund Cabaçal DFS work, Santa Helena resource growth (MNO.TO)

Lotus completed its $76m placement (LOT) Down 29%

In the Weeds

What really killed Rio Tinto and Glencore’s $300B dream deal (AFR Chanticleer)

Finally, the Rio Tinto-Glencore deal is recognised as the joke it is (Rampart)

The hill upon which Rio-Glencore’s merger talks died (AFR Analysis)

Rio Tinto Asset Sales: Richards Bay Minerals (Part 2 of 3) (MVA)

Flash Crash (Campbell Ramble) Highlighting silver’s (continued) crazy volatility. 17% move in 2 hours yesterday

This Is How The US Can Become a Player in Rare Earth Metals (Bloomberg)

Friedland’s Ivanhoe Atlantic sued by former CEO for unfair dismissal (AFR)

China Trader Who Made US$3B on Gold Bets Big Against Silver (Bloomberg)

Solstice shares head for the sun (Livewire)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

We’ve all experienced this year’s volatility.

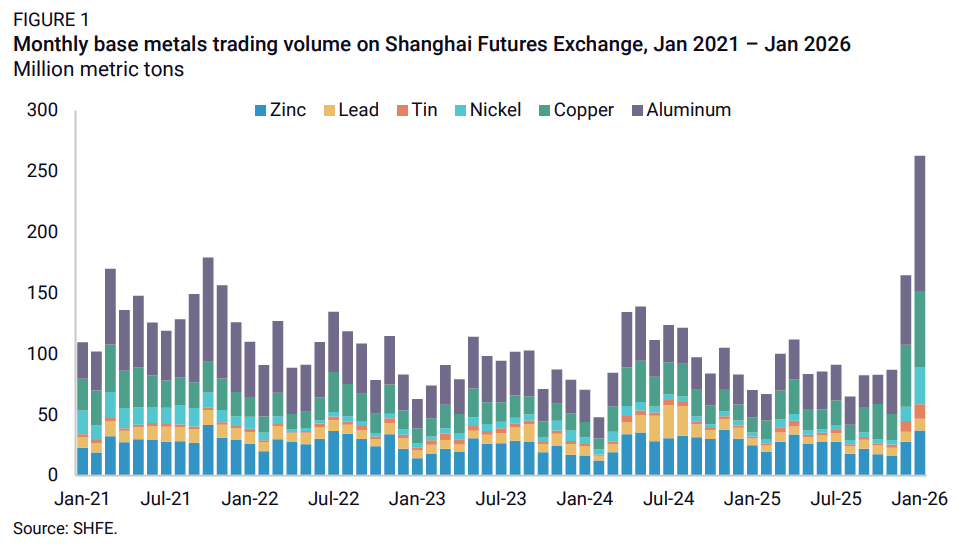

The chart below captures these moves in the base metals.

Take tin as an example, where daily trading volume exceeded annual global production.

These moves will live long in the memory.

Credit: Rhodium Group

Our Latest Show

Coal's Inflection Point: AI Collides With Energy (Matt Warder)

Stocks mentioned: WHC, SMR, NHC, BHP, GLEN.L, BSL, RIO, BTU.NY, HCC.NY, AMR.NY, METC.N, AAL.L

You’re reading this.

So are 16,000 other very influential people in the mining sector.

Reach them where they are paying attention 👇