The Pre-Start

South32 announced that Matthew Daley, previously of Anglo & Glencore, will join as Deputy CEO from Feb 2nd 2026, and will assume the CEO role later that year (S32)

Minerals 260 shared a gold exploration strategy with plans to drill 80km, targeting resource extension targets at depth & along strike (MI6)

Pantoro repaid its convertible loan facility with Nebari, making it debt-free (PNR)

Core Lithium settled its legacy offtake agreement with Yahua with a US$2m payment, terminating the arrangement (CXO)

Firebird performed calcining & leaching trials, testing low-grade manganese ore for HPMSM production, showing reduced energy requirements (FRB)

Euro Manganese announced a new CEO in Martina Blahova (EMN)

High Grade It

Officials from the U.S. & China wrapped up their high-stakes trade talks, with Beijing saying the two sides agreed to start a formal negotiation process (WSJ)

What is Gina Rinehart’s plan for lithium miner Liontown? Analysts’ views differ whilst Hancock remains quiet & the commodity continues declining (AFR)

CATL is planning to limit the types of US investors that can participate in its Hong Kong listing, an indication that trade tensions may be spilling into the IPO market (Bloomberg)

AMEC lashed Lynas’ chief Amanda Lacaze’s brusque comments about Australian manufacturing ambitions and plans to stockpile critical minerals as “negativity” and “insulting” (West)

The soaring price of gold is creating a boom for security box providers and traders, with local demand driven by younger buyers (AFR)

Peruvian gold output is expected to be significantly dented in the coming month due to a mining ban in a northern region, forgoing US$200m (Bloomberg)

First Quantum remains cautiously optimistic about its prospects in Panama as the government weighs how & when to reopen the shuttered mine (Mining.com)

BYD & Tsingshan reiterated their interest in building lithium plants in Chile, appearing to contradict comments by local authorities that the projects had been scrapped (Bloomberg)

Twangiza Mining, a gold miner operating in the rebel-controlled South Kivu, DRC said it has been ordered to suspend operations by the rebel administration, according to a company-wide letter (Reuters)

Energy producers have warned of Australia’s last chance to fix East Coast gas as the market teeters on the brink of crisis (Australian)

Hit the link and get your tickets to learn more from the mine modelling whizzes at Model Answer!

Wheelin’ n Dealin’

Rattlin’ the Tin

Word on the Decline

So Liontown closed the day 18% higher on Friday meanwhile lithium SC6 grinds down to US$680/t… Huh?

No wonder Pete Ker has asked: What is Gina’s plan for Liontown?

If there’s one certainty when it comes to M&A and Australia’s richest woman: it’s that no one has a god damn clue

Do you have some Word on the Decline? Reply to this email or shoot a message to [email protected] directly. We will always take your privacy seriously.

In the Weeds

BHP miner sacked for work fight wins job back (Australian)

A gallium lens on China's minerals dominance and how to break it (Reuters op-ed)

US-China trade deal is fake news, but markets won’t care (AFR’s Chanticleer)

World turns in favour of Forrest-owned mining company Wyloo after nickel nightmare (Australian) “so far made a profit of about $450m on paper in backing Greatland over the past three years”

Meet the scrappy Queenslander who convinced Trump to mine the sea (AFR)

Canada looks for bright spots as diamond mines wind down (FT)

Coal lobby spins electoral defeat to its advantage (AFR’s Rear Window)

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

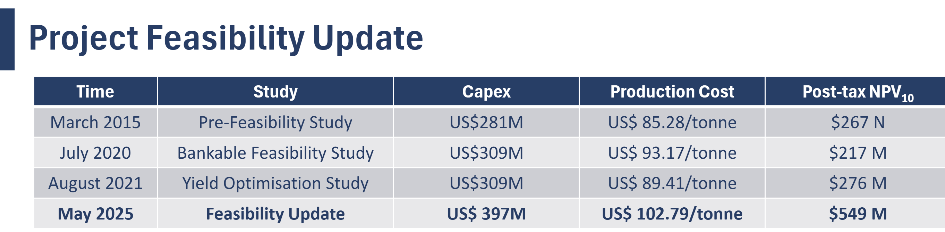

If capex is going up, opex is going up and NPV is also going up, I think we need a column for coal price assumption too...

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube