The Pre-Start

Anglo American produced 184kt Cu, 14.3Mt Fe and 973kt Mn over the quarter, stronger than expected across the board. Minas Rio guidance was upgraded, while Collahuasi was slightly weaker (AAL.L)

Lynas will establish a Heavy Rare Earths separation facility at Lynas Malaysia with up to 5ktpa capacity, costing about $180m, self-funded after its September 2025 equity raise, with first Samarium production due April 2026 (LYC)

First Quantum announced a US$48m loss for the quarter, on EBITDA of US$435m. Copper guidance narrowed to 390-410kt and gold to 140-150koz. Kansanshi S3 is ramping up on schedule (FM.TO)

Capricorn reported Q1 production of 32.3koz at an AISC of A$1,625/oz, record operating cash flow of A$91m, progressed Karlawinda Expansion construction & the Supreme Court directed Warriedar scheme meetings for 6 Nov (CMM)

Alcoa’s quarterly showed Q3 sales of US$3B & net income of US$232m (AAI)

Boss drummed 386klb of U3O8, realising a price of US$74.7/lb. IX production was down 20kld on the previous quarter. Its AISC came in at US$33/lb, while cash, investments, receivables & inventory fell by $12m (BOE) Up 15%

Alkane reported a record Q1 FY26 with A$73m operating cashflow, ~30koz AuEq at AISC A$2,988/oz, A$191m cash and investments, after completion of the $1B merger with Mandalay, lifting it into the ASX 300 (ALK)

Metals X reported Renison produced 2.3kt of tin (MLX 50% share 1.1kt) and closed with cash of $280m, up $49m (MLX)

Ioneer reduced vat leach retention to 1.5 days, lifting its NPV by 19% to US$2.2B, increasing lithium and boric acid outputs, raising throughput to 3.4Mtpa with only a US$15m capital cost increase (INR)

Elevra reported NAL production of 52kt of SC5.2 (down 11%), on the back of lower plant utilisation & recoveries. Unit operating costs (on tonnes sold) were US$818/dmt, with sales being weighted to the Dec quarter (ELV)

Profit at Hancock Prospecting subsidiary Atlas Iron fell sharply due to weaker iron ore prices, totalling $260m (-40%) on sales of 10Mt (BN)

Black Cat produced 20.5koz over the quarter, not reporting an AISC. Cash, bullion and listed investments rising to $90m (from $56m), as Paulsens ramps up (BC8)

The Malawian gov’t confirmed Kangankunde is not impacted by Executive Order No.2, as ore will be beneficiated into monazite concentrate before export (LIN)

Ionic Rare Earths will consolidate its shares on a 30-for-1 basis, effective 1 December 2025 (IXR)

Dreadnought upgraded its Star of Mangaroon scoping study, boosting the initial open‑pit target to ~24koz @ 8.3g/t, cutting max cash drawdown to ~$5.4m and forecasting ~$78m operating cashflow at A$5,500/oz (DRE)

High Grade It

The U.S. gov’t inked a partnership with Westinghouse Electric that aims to build at least US$80B in nuclear reactors (Reuters)

Taxpayer-funded Liontown continues to spend more than it earns, despite a rebound in lithium prices, with breakeven approaching (AFR)

BHP will scale back its Yandi iron ore mine after extracting years of extra life out of the 34-year-old deposit (BN)

Australia’s biggest aluminium smelter, Tomago, has started a consultation process with employees for the plant’s potential closure in just over 3 years, despite a government bailout offer to keep it operating (AFR)

The record wave of retail investors flooding into gold has abruptly reversed course, unleashing wild price swings (AFR) All the fuss over a 3 week low!

South Korea’s central bank is weighing plans to add to its gold reserves for the first time in more than a decade (Bloomberg)

China's curbs on coal production could tighten further toward the end of 2025, making a rebound in output in the world's largest producer unlikely (Reuters)

Got ounces in the ground that are waiting to be mined? Get in touch with the team at Blue Cap Mining and start printing profits in no time!

Cameco and Brookfield have established a partnership with the US Government to arrange financing and facilitate the permitting and approvals for new Westinghouse nuclear reactors to be built in the US, with an aggregate investment value of at least US$80 billion (CCO.TO)

Almonty will acquire the Gentung Browns Lake tungsten project in Montana for US$9.75m (US$750,000 cash & US$9m in shares) (AII)

Rattlin’ the Tin

Arafura Rare Earths is raising $525m at 28c as its market value tops $1B (Australian) with Gina Rinehart almost doubling her stake to 15.7% (Bloomberg, ARU) Plus Hatch selected as preferred EPCM provider

Golden Horse is raising $25m at 66c (GHM)

Aeris has launched an $85m capital raising to repay its Soul Patts debt (AFR)

Ballard secured ~$21m via a 55c placement led by Aurenne (to hold 9.6%), with proceeds to fund Mt Ida growth and planned deeper drilling programs (BM1)

KGL is in a trading halt pending an announcement regarding a capital raising (KGL)

Word on the Wiluna Decline

After running our story yesterday on Creasy’s perpetual interest in Wiluna to process his Bogada Bore gold deposit, we fielded a few emails that led us to believe the great prospector could be a few inches away from the dream

Here’s what we know:

2 days ago, Wiluna revealed that unsecured creditors are going to get 100 cents on the dollar back in short order. Previously, the creditors trust wouldn’t get repaid until Byrnecut’s debt was repaid in full

Creasy has made an offer to Milan Jerkovic for his shares at 50c per share (WMC last traded +3yrs ago at 19c per share) and an offer at the same price has been extended to other Wiluna shareholders too

The administrators are seeking court orders to bring the administration of Wiluna to an end

Here’s our unanswered open question:

Has Creasy struck a deal with Byrnecut to buy their debt?

Got Word on the Decline? Simply reply or email [email protected]. We will always take your privacy seriously.

In the Weeds

The Rare Earth Observer (TREO) Dual-Use Rules; Malaysia-US RE "Deal"; US throw more money at RE juniors

Greenlight Capital (Q3 Letter) David Einhorn is always worth reading. Great insight on AI valuations & Teck Resources

September Fund Performance (MrQuick) Recap of Aussie funds. Some outstanding 1, 3 & 12-month performance across Resources

Praetorian Capital (Q3 Letter) “Put simply, a shiny rock should not be outperforming real businesses that are retaining capital and reinvesting it at a rate of return that is higher than the cost of capital”

Secret documents reveal WA government’s Wittenoom dilemma (BN)

Three Buckets of Asymmetry (Trader Ferg) Where is the relative value now?

Were you forwarded this email from someone else?

Today’s Top Tweet

Devil’s in the Detail

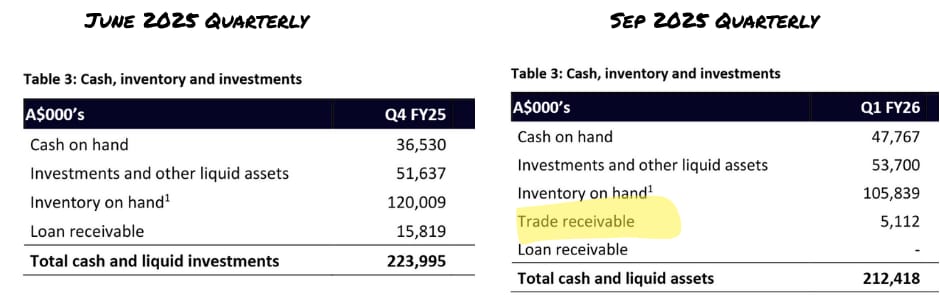

How many things can we include to make the change in cash appear not terrible?

Boss Energy throws in a new one!

Plus, this from Lynas today. Self-funded with an equity raise…

We’re in oxymoron territory here.

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube

The Playbook Behind Evolution’s $20B Gold Success

The story of how Evolution rose from a junior with a busted project to be one of Australia’s best business success stories, all in under 15 years.

This one is a monster, but it’s worth it.